What You Need to Know and How to Deal With It

Inflation is an economic phenomenon that affects all of us in one way or another. But what does inflation exactly mean, and how does it impact your daily life? In this post, we will explore inflation, its causes, and how you can protect your purchasing power.

What is Inflation?

Inflation is a general and continuous increase in the prices of goods and services in a country’s economy. This means that over time, the goods and services we buy become more expensive. This price increase is quantified as the inflation rate, calculated as the percentage change in the average price of goods and services purchased by a typical household.

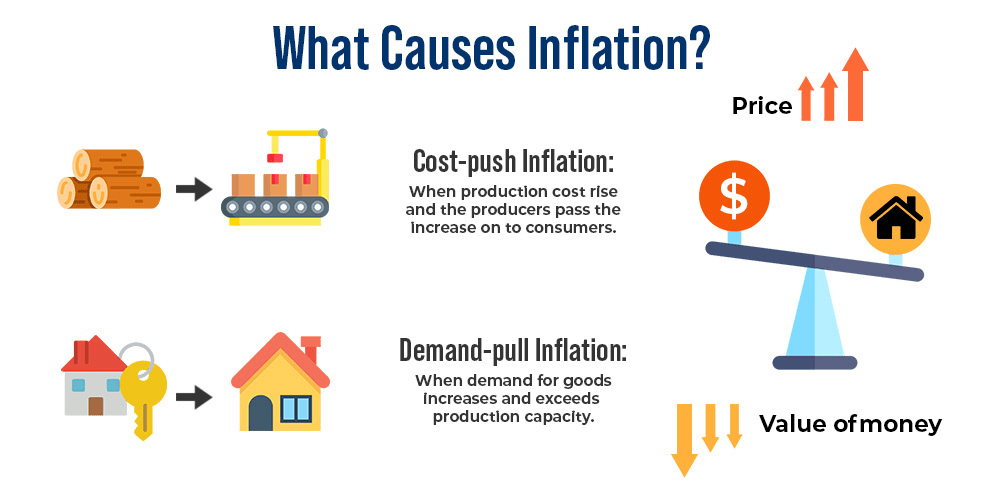

Causes of Inflation

There are several causes contributing to inflation, including:

- Increased Demand: When the demand for goods and services rises faster than their availability, prices tend to increase.

- Rising Costs: If production costs increase, such as due to rising prices of raw materials, the prices of finished goods and services tend to follow suit.

- Currency Devaluation: If a country’s currency loses value against foreign currencies, imported goods tend to become more expensive.

Effects of Inflation

- Decreased Purchasing Power: As inflation rises, the value of currency falls, leading to decreased purchasing power. This is particularly hard on retirees and those on fixed incomes.

- Interest Rate Adjustments: Central banks often adjust interest rates to control inflation. Higher interest rates typically reduce spending and borrowing, which can slow inflation.

- Investment Valuation: Inflation can erode investment returns. Investors seek higher returns to compensate for this loss in purchasing power.

- Income Redistribution: Inflation can impact various groups differently, often benefiting debtors (who repay loans with money that’s worth less) while harming savers.

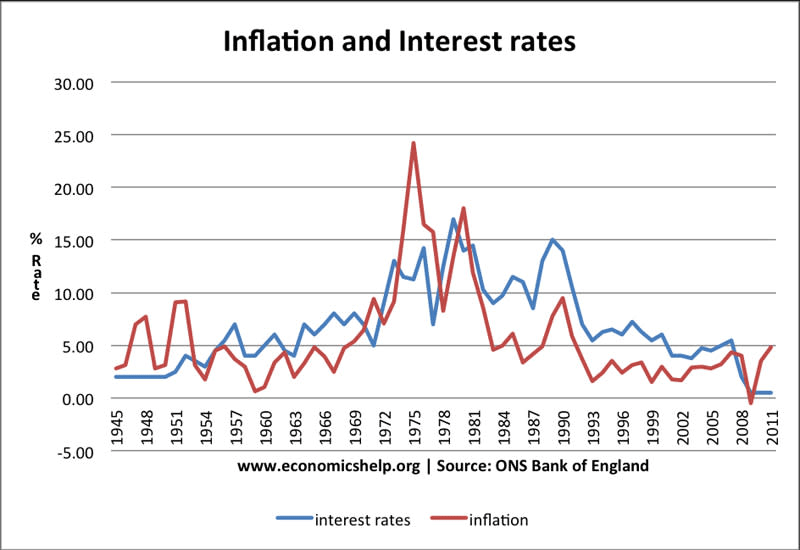

Inflation and Interest rates

The relationship between inflation and interest rates is pivotal in monetary policy, where central banks adjust interest rates to control inflation and stabilize the economy. Higher inflation typically leads to higher interest rates as central banks aim to cool down economic activity by making borrowing more expensive and saving more appealing, thereby reducing spending. Conversely, lower inflation might prompt central banks to lower interest rates to encourage borrowing, spending, and investment, fostering economic growth. This balancing act is crucial for maintaining economic stability, with interest rate adjustments serving as a primary tool for managing inflationary pressures and supporting sustainable economic development.

Dealing with Inflation

Inflation can significantly impact your purchasing power, but there are steps you can take to protect your money:

- Invest in Safe Havens: Investments in safe havens like gold, silver, and real estate often retain their value during inflationary periods.

- Diversify Your Investments: Don’t put all your eggs in one basket. Diversify your investments among stocks, bonds, and real estate to reduce risk.

- Save Money: Set aside money every month in a savings account or pension fund, creating an emergency fund for unexpected needs.

How to Calculate Inflation

The most common way to calculate inflation is through the Consumer Price Index (CPI). The CPI measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

(CPI in the current year−CPI in the previous yearCPI in the previous year)×100Inflation Rate=(CPI in the previous yearCPI in the current year−CPI in the previous year)×100

This formula gives you the percentage rate of inflation over a year.

In conclusion, inflation is a phenomenon that affects us all and can have a significant impact. By understanding its causes and taking proactive financial steps, you can mitigate its effects and secure your financial future.

To make our community even richer and more interactive, I invite you to participate actively! 🙌

Share the posts you find interesting, express your reactions, and don’t hesitate to leave a comment. Each of your actions helps spread financial knowledge to a wider audience. 📢💬

I am particularly interested in knowing your point of view: comment with your feedback, suggestions, or topics you would like to delve into. Your opinion is valuable for improving the content and offering insights more in line with your needs. 🔄🔍

Together, we can build a community where finance is accessible to everyone. Thank you for your support! 💖

Disclaimer 📜

Please note: The content shared across our channels, including articles, videos, and podcasts, reflects personal opinions and experiences. It is not intended as financial advice or an endorsement of specific strategies or products. 🚫

This information serves educational purposes only and should not be taken as professional financial guidance. Before making any financial decisions, we strongly recommend consulting with a qualified financial advisor. 📊➡️👨💼