Estimated time to Read: 5 minutes 🕒

Introduction

Did you know that even a small change in interest rates can significantly affect your savings and investments over time? This seemingly minor detail can be the difference between a comfortable retirement and financial stress. Interest rates are not just numbers set by central banks; they’re powerful tools that shape economic growth, influence stock markets, and directly impact your wallet.

Why Interest Rates Matter in Finance

The Role of Interest Rates

Interest rates are the cost of borrowing money, expressed as a percentage of the amount borrowed. They influence every aspect of financial planning, from mortgages and personal loans to savings accounts and investments. Understanding how interest rates work is crucial for anyone looking to make informed decisions about their finances.

How Do Interest Rates Work?

Central banks, like the Federal Reserve in the United States, adjust interest rates to control economic growth. High rates can slow borrowing and spending, cooling an overheated economy. Conversely, lower rates make borrowing cheaper, encouraging spending and investment. This delicate balance is essential for maintaining economic stability.

Impact on Investments and Savings

Savings Accounts and CDs

Higher interest rates mean better returns on savings accounts and Certificates of Deposit (CDs). However, when rates are low, your savings may not grow as expected, pushing investors towards higher-risk options.

Bonds and Stocks

The bond market is inversely related to interest rates. When rates rise, bond prices typically fall, and vice versa. Stocks, on the other hand, can be both positively and negatively affected by interest rate changes, depending on the sector and the economic context.

Interest Rates in Financial Planning

Strategies for Savers and Investors

- Diversify Your Portfolio: Balance between stocks, bonds, and savings to mitigate risks associated with fluctuating interest rates.

- Fixed vs. Variable Loans: Consider locking in fixed rates for long-term loans when rates are low. Conversely, variable-rate loans might be beneficial in a high-rate environment expected to decline.

- Stay Informed: Keep an eye on economic indicators and central bank announcements to anticipate rate changes.

Risks and Challenges

While leveraging interest rates can lead to financial gains, there are risks involved. Economic predictions can be wrong, and global events can quickly change the financial landscape. It’s important to approach interest rate-based decisions with caution and a well-thought-out plan.

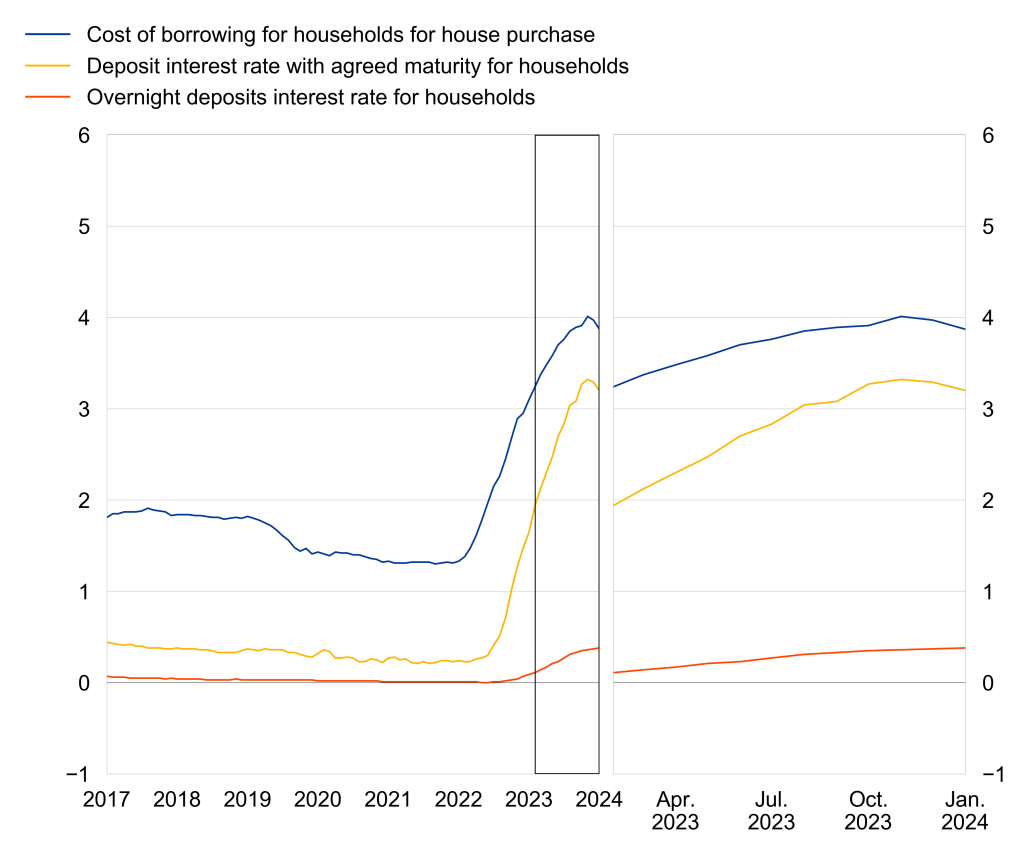

Euro area 2024

In January 2024, the Euro area bank interest rate statistics revealed nuanced shifts across various loan and deposit categories, reflecting the complex interplay of market dynamics. For corporations, the composite cost-of-borrowing indicator remained stable at 5.22%, while new household loans for house purchases became slightly more affordable, with rates dropping by 10 basis points to 3.87%. This was primarily attributed to an interest rate effect. On the deposit front, corporate entities saw a slight decrease in the interest rates for new deposits with agreed maturity, down by 4 basis points to 3.68%, and a small rise for overnight deposits, up by 6 basis points to 0.89%. Households experienced a decrease in rates for new deposits with agreed maturity to 3.20% and saw no significant change in the rates for overnight deposits, maintaining at 0.38%. These shifts underscore the fluctuating nature of bank interest rates in the euro area, influenced by factors such as loan sizes, periods of rate fixation, and the broader economic environment, offering a detailed snapshot of the current financial landscape for both borrowing and savings within the corporate and household sectors.

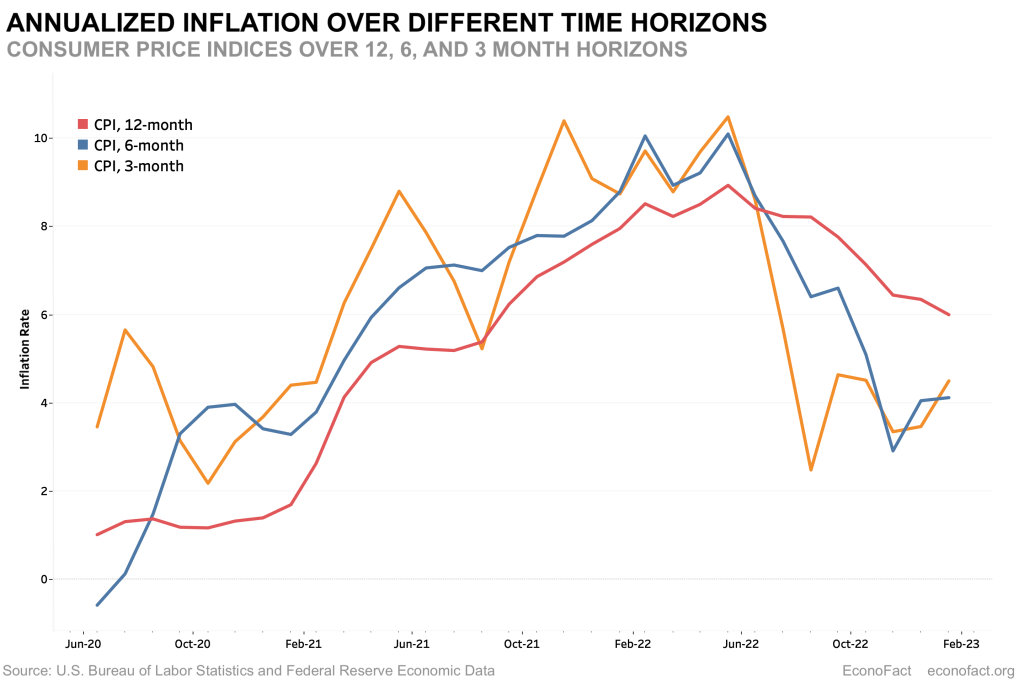

Central banks in recent years

In the tumultuous aftermath of the 2008 financial crisis, central banks across the globe undertook unprecedented monetary policy measures to stem the economic fallout, showcasing a pivotal moment in economic crisis management. The crisis, triggered by the collapse of the housing bubble in the United States, quickly cascaded into a global financial meltdown, prompting central banks to swiftly and decisively adjust interest rates to combat the ensuing recession and spiraling inflation.

The Federal Reserve (Fed) led by example, slashing the Federal Funds Rate from 5.25% in September 2007 to near zero by the end of 2008. This aggressive rate reduction was aimed at boosting economic activity by making borrowing cheaper, thereby encouraging spending and investment. Similarly, the European Central Bank (ECB) and the Bank of England (BoE) significantly lowered their benchmark rates to facilitate cheaper credit, attempting to stabilize the financial system and foster economic recovery.

Moreover, beyond conventional rate cuts, central banks ventured into uncharted territory with quantitative easing (QE) programs. QE involved the large-scale purchase of government securities to inject liquidity directly into the economy, further easing monetary conditions when traditional policy tools had reached their limits.

The lessons learned from 2008 have profoundly influenced central bank strategies in dealing with subsequent economic challenges. The swift, decisive actions taken underscored the importance of flexible monetary policy in crisis response. Central banks now possess a more comprehensive toolkit, including lower bound interest rates and QE, to combat economic downturns and inflationary pressures. Additionally, the crisis highlighted the need for more robust financial regulation and oversight to prevent excessive risk-taking that could lead to similar crises.

As we navigate future economic landscapes, the 2008 crisis serves as a crucial reference point. It demonstrates the effectiveness of aggressive monetary policy in crisis mitigation, the potential of unconventional tools like QE, and the importance of regulatory measures in maintaining financial stability. Central banks continue to apply these lessons, balancing the need to support economic growth with the imperative to maintain inflation within target ranges, ensuring that the global financial system is better equipped to handle future shocks.

References

- https://www.ecb.europa.eu/press/pr/stats/mfi/html/ecb.mir2403~1645c6dcce.en.html

- https://www.bbc.com/news/business-67713669

- https://econofact.org/when-should-the-fed-stop-raising-interest-rates

- https://newsletter.pragmaticengineer.com/p/zirp

To make our community even richer and more interactive, I invite you to participate actively! 🙌

Share the posts you find interesting, express your reactions, and don’t hesitate to leave a comment. Each of your actions helps spread financial knowledge to a wider audience. 📢💬

I am particularly interested in knowing your point of view: comment with your feedback, suggestions, or topics you would like to delve into. Your opinion is valuable for improving the content and offering insights more in line with your needs. 🔄🔍

Together, we can build a community where finance is accessible to everyone. Thank you for your support! 💖

Disclaimer 📜

Please note: The content shared across the channels reflects personal opinions and experiences. It is not intended as financial advice or an endorsement of specific strategies or products. 🚫

This information serves educational purposes only and should not be taken as professional financial guidance. Before making any financial decisions, we strongly recommend consulting with a qualified financial advisor. 📊➡️👨💼