Breaking Down the Concept:

The Wyckoff strategy, developed by renowned trader Richard Wyckoff, is a methodology that analyzes price and volume to identify market trends and anticipate future price movements. At its core, the strategy focuses on understanding the intentions of market participants, gauging supply and demand dynamics, and identifying accumulation and distribution phases.

Significance and Impact:

By mastering the Wyckoff strategy, investors gain a deeper insight into market dynamics, enabling them to make more accurate predictions and capitalize on profitable opportunities. Whether you’re a seasoned trader or a novice investor, incorporating Wyckoff principles into your trading arsenal can enhance your decision-making process and improve overall performance.

Practical Advice and Strategies:

To leverage the Wyckoff strategy effectively, investors should familiarize themselves with key concepts such as price structure, volume analysis, and market phases. By studying real-world examples and case studies, individuals can gain a practical understanding of how to apply Wyckoff principles in various market conditions.

Potential Risks and Challenges:

While the Wyckoff strategy offers valuable insights, it’s essential to acknowledge the potential risks and challenges associated with its implementation. Market volatility, false signals, and emotional biases can impact decision-making, requiring investors to exercise caution and discipline.

Here’s how it works:

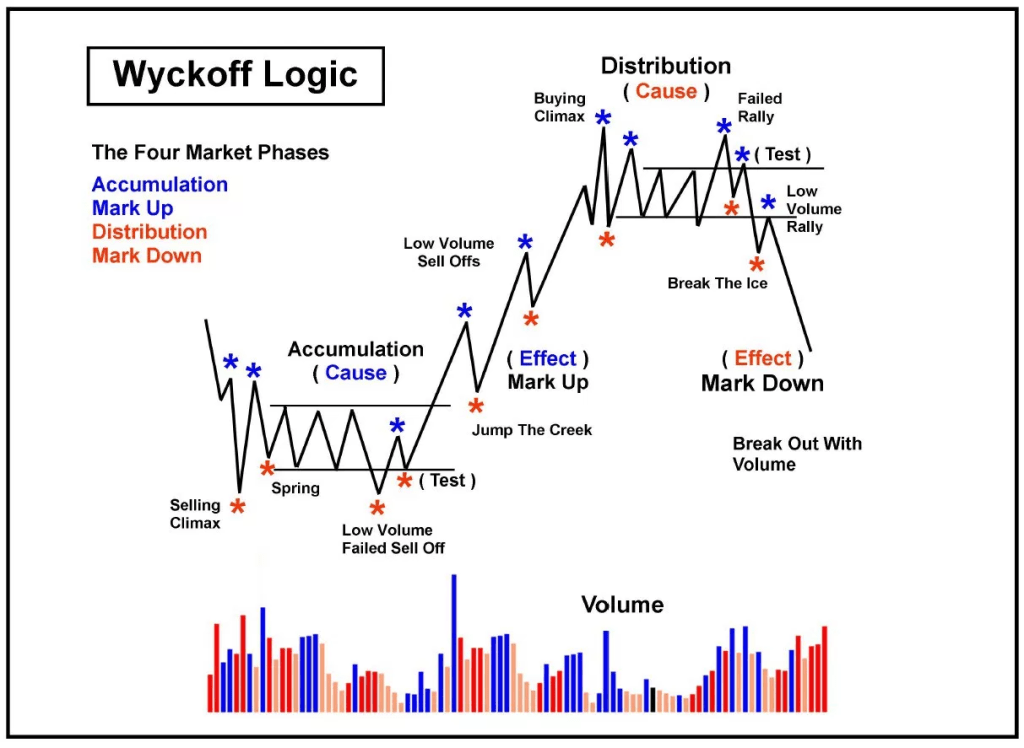

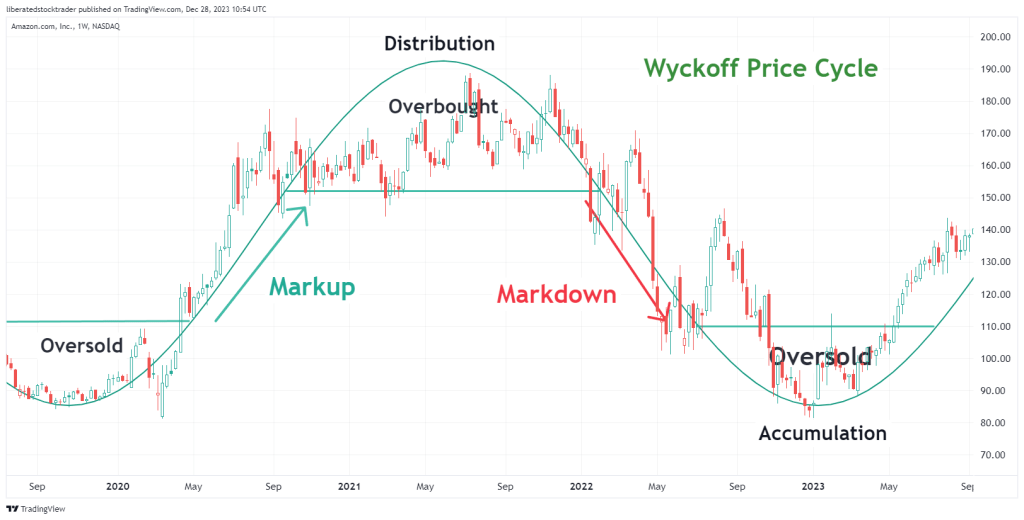

- Accumulation and Distribution Phases: The Wyckoff strategy revolves around the concept of accumulation and distribution phases. During the accumulation phase, smart money (institutional investors or large traders) gradually accumulates shares at lower prices, often under the radar of the general market. This phase is characterized by sideways price movement or a slight downtrend. Conversely, during the distribution phase, smart money sells off its accumulated shares to the uninformed public, resulting in a downtrend or sideways movement in prices.

- Price and Volume Analysis: The strategy relies heavily on analyzing price and volume data to identify these accumulation and distribution phases. Traders look for specific patterns and signals in price charts, such as price consolidations, breakouts, or volume spikes, to confirm the presence of these phases.

- Wyckoff Schematics: Wyckoff introduced several schematics or patterns that help traders recognize accumulation and distribution phases. These schematics include the Wyckoff Spring (a false breakdown below support levels followed by a quick recovery), the Upthrust (a false breakout above resistance levels followed by a reversal), and the Buying and Selling Climaxes (extreme volume spikes indicating potential reversal points).

- Confirmation Signals: Once traders identify potential accumulation or distribution phases, they wait for confirmation signals before taking action. Confirmation may come in the form of price breakouts, volume expansions, or specific chart patterns that validate the presence of smart money activity.

- Trade Execution: Traders can execute trades based on Wyckoff signals, such as buying during accumulation phases when prices are low and selling during distribution phases when prices are high. Stop-loss orders and risk management techniques are crucial to protect against adverse price movements.

- Continuous Monitoring: The Wyckoff strategy requires continuous monitoring of price and volume data to adjust trading decisions as market conditions evolve. Traders must remain vigilant for signs of trend reversals or shifts in market sentiment that could invalidate their initial analysis.

In summary, the Wyckoff strategy provides traders with a systematic framework for analyzing market trends and identifying optimal entry and exit points based on the actions of smart money. By mastering Wyckoff principles and patterns, traders can gain a competitive edge in navigating financial markets with confidence and precision.

Conclusion:

As you embark on your journey to master the Wyckoff strategy, remember that education and continuous learning are key. Consult with experienced traders, immerse yourself in educational resources, and practice applying Wyckoff principles in simulated trading environments. By adopting a proactive approach to financial education and embracing the Wyckoff strategy, you can navigate the complexities of financial markets with confidence and precision.

#WyckoffStrategy #FinancialMarkets #InvestmentStrategy #TradingTips #MarketAnalysis

References

- https://www.investopedia.com/articles/active-trading/070715/making-money-wyckoff-way.asp#:~:text=The%20Wyckoff%20Method%20is%20a,markup%2C%20distribution%2C%20and%20markdown.

- https://medium.datadriveninvestor.com/94b4934f6fb8

To make our community even richer and more interactive, I invite you to participate actively! 🙌

Share the posts you find interesting, express your reactions, and don’t hesitate to leave a comment. Each of your actions helps spread financial knowledge to a wider audience. 📢💬

I am particularly interested in knowing your point of view: comment with your feedback, suggestions, or topics you would like to delve into. Your opinion is valuable for improving the content and offering insights more in line with your needs. 🔄🔍

Together, we can build a community where finance is accessible to everyone. Thank you for your support! 💖

Disclaimer 📜

Please note: The content shared across the channels reflects personal opinions and experiences. It is not intended as financial advice or an endorsement of specific strategies or products. 🚫

This information serves educational purposes only and should not be taken as professional financial guidance. Before making any financial decisions, we strongly recommend consulting with a qualified financial advisor. 📊➡️👨💼