Part 1: Introduction

Have you ever felt overwhelmed by the sea of financial advice and investment options out there? You’re not alone.

Navigating the complex world of investments can be daunting, especially without a clear roadmap. This is where an Investment Policy Statement (IPS) comes into play—a strategic tool often overlooked by individual investors. Understanding and creating your own IPS can significantly clarify your financial goals, streamline your investment decisions, and enhance your overall financial security.

Let’s dive into what an IPS is, why it’s crucial for every investor, and how it can transform your investment approach.

Part 2: Content

Understanding the Investment Policy Statement

An Investment Policy Statement is essentially a written plan that outlines an investor’s financial goals and the strategies to achieve them. It sets the ground rules for making investment decisions, specifying the types of investments that fit the investor’s profile, the risk tolerance, and the expected return on investment.

Structuring Your IPS: A Guide for Investors

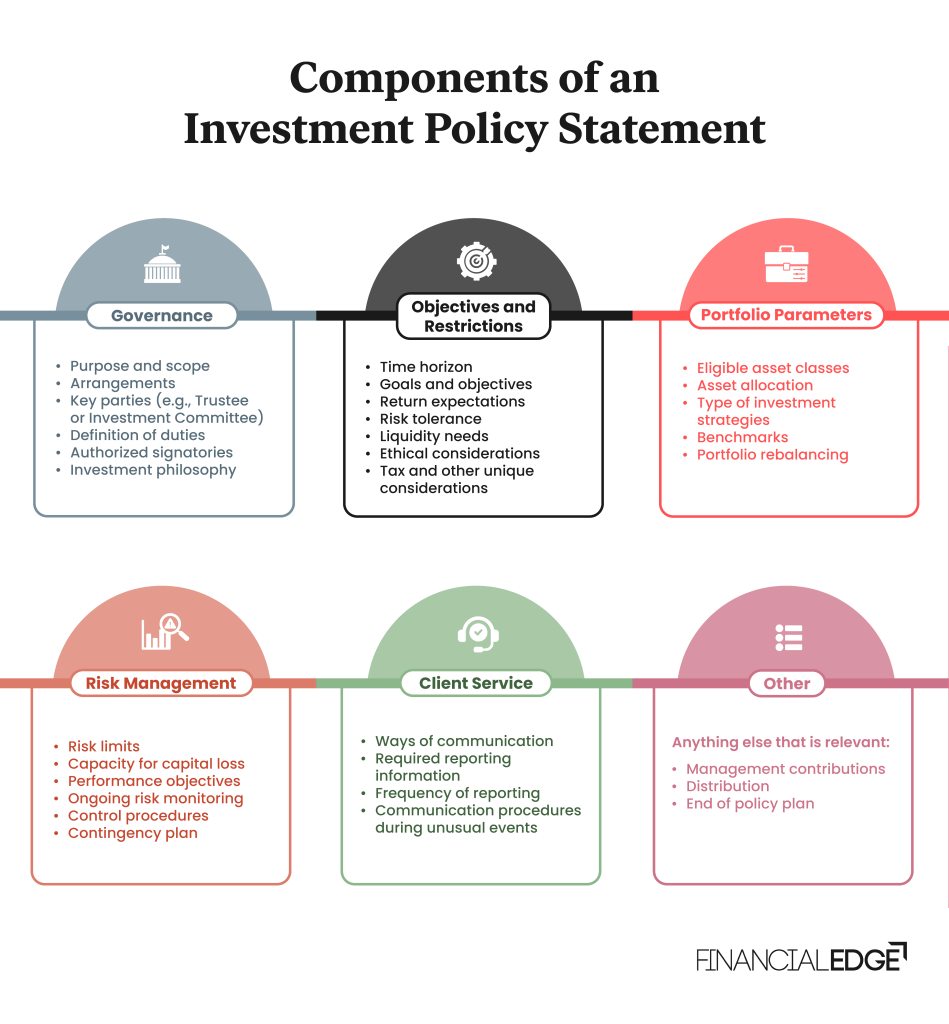

Creating an IPS involves several key components:

- Objectives and Goals: Clearly define what you aim to achieve, such as retirement savings, education funds, or wealth accumulation.

- Risk Tolerance: Assess your ability to stomach fluctuations in investment value. This will guide the selection of appropriate investment vehicles.

- Investment Strategy: Outline a coherent strategy that includes asset allocation, diversification tactics, and rebalancing schedules.

- Selection Criteria: Determine the benchmarks for selecting individual investments or fund managers.

- Monitoring and Reviewing: Establish how often to review the portfolio to ensure it remains aligned with your goals.

Practical Tips and Real-World Applications

Imagine a scenario where an individual investor, through a well-drafted IPS, decided to allocate 60% of their portfolio to stocks and 40% to bonds, based on a moderate risk tolerance. This strategy helped them weather a volatile market, as the bonds provided stability when stocks declined, and vice versa, illustrating the importance of diversification discussed in their IPS.

Navigating Risks and Challenges

While an IPS is a powerful tool, it’s not without risks. Market conditions can change rapidly, making it necessary to adapt your investment strategy. Regularly updating your IPS can mitigate these risks and help capture new opportunities without straying from your financial goals.

References

- Book – https://www.amazon.it/Linvestitore-intelligente-Benjamin-Graham/dp/8820396246

- https://www.fe.training/free-resources/portfolio-management/investment-policy-statement-ips/

- https://www.investopedia.com/terms/i/ips.asp

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/investment-policy-statement-ips/#:~:text=The%20components%20of%20an%20investment,decisions%20related%20to%20their%20portfolio.

To make our community even richer and more interactive, I invite you to participate actively! 🙌

Share the posts you find interesting, express your reactions, and don’t hesitate to leave a comment. Each of your actions helps spread financial knowledge to a wider audience. 📢💬

I am particularly interested in knowing your point of view: comment with your feedback, suggestions, or topics you would like to delve into. Your opinion is valuable for improving the content and offering insights more in line with your needs. 🔄🔍

Together, we can build a community where finance is accessible to everyone. Thank you for your support! 💖

Disclaimer 📜

Please note: The content shared across the channels reflects personal opinions and experiences. It is not intended as financial advice or an endorsement of specific strategies or products. 🚫

This information serves educational purposes only and should not be taken as professional financial guidance. Before making any financial decisions, we strongly recommend consulting with a qualified financial advisor. 📊➡️👨💼

#InvestmentPolicyStatement, #FinancialPlanning, #InvestmentStrategy, #RiskManagement, #AssetAllocation, #PortfolioManagement, #FinancialGoals, #InvestingBasics, #WealthManagement, #FinancialLiteracy

This layout should effectively capture the essence of what an IPS can do for individual investors, making it a cornerstone of smart investment planning and a topic worth sharing and discussing within your financial community.