Estimated Time to Read: 5 minutes 🕒

Whether you hold stocks, bonds, real estate, or a combination of different assets, meticulous tracking is the cornerstone of effective asset management.

Let’s explore why and how you should track your investments using tools like Excel, Python, or specialized external software.

The Necessity of Investment Tracking Tools

Tracking your investments goes beyond just knowing what assets you hold. It’s about understanding the intricate details of your portfolio’s performance and the factors influencing it.

Here are some compelling reasons why using sophisticated tracking tools is essential:

1. Comprehensive Performance Analysis

To manage a diverse portfolio effectively, you need to analyze various performance metrics such as returns, volatility, and correlation between assets. Tracking tools allow you to compile and scrutinize these metrics, providing a holistic view of your portfolio’s health.

2. Enhanced Decision Making

By leveraging data from tracking tools, you can make well-informed decisions. These tools enable you to monitor real-time performance and historical trends, ensuring your investment choices are based on solid analysis rather than gut feelings.

3. Risk Management

Understanding the risk associated with each asset and the portfolio as a whole is crucial. Tracking tools help identify risk factors and potential vulnerabilities, allowing you to adjust your strategy proactively to mitigate potential losses.

4. Goal Setting and Monitoring

Effective investment management requires setting clear, realistic goals and continuously monitoring progress. Tracking tools help you set performance benchmarks and track your progress towards achieving your investment objectives.

Implementing Investment Tracking Tools

Here are some steps to effectively implement and utilize investment tracking tools:

1. Choose the Right Tools

Depending on your needs, you can choose from various tools like Excel for basic tracking, Python for advanced analytics, or specialized software like Quicken, Personal Capital, or Portfolio Performance. Each tool has its strengths, and the choice depends on the complexity of your portfolio and your analytical requirements.

2. Define Key Metrics

Identify the financial and statistical metrics that are most relevant to your investment strategy. Common metrics include return on investment (ROI), standard deviation, Sharpe ratio, and beta. These metrics will help you assess performance, risk, and overall portfolio stability.

3. Regular Updates and Reviews

Keeping your data up-to-date is crucial. Regularly input new data such as dividends, interest payments, and market value changes. Conduct periodic reviews to assess the performance and make necessary adjustments based on current market conditions and your investment goals.

4. Diversification and Correlation Analysis

A well-diversified portfolio spreads risk across different asset classes. Use tracking tools to analyze the correlation between different assets. Understanding these relationships can help you optimize your asset allocation to achieve better risk-adjusted returns.

Practical Applications

Excel:

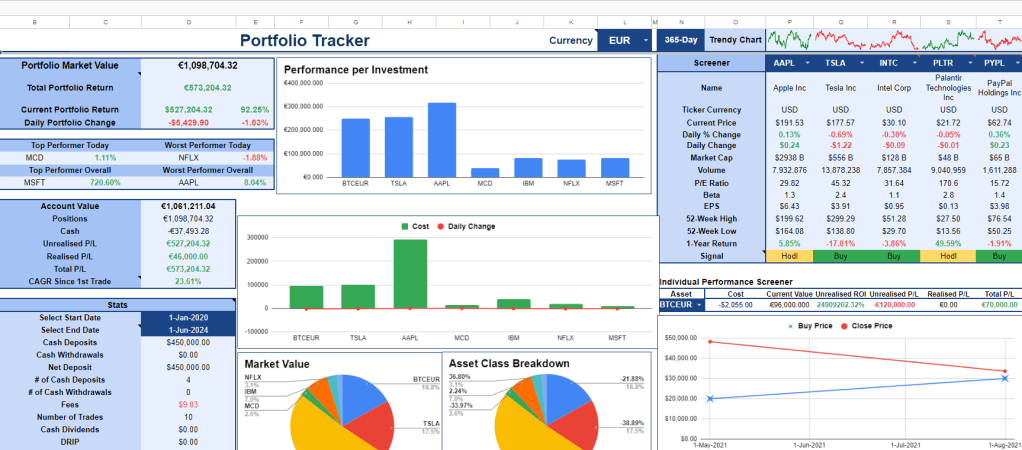

Excel is a powerful tool for tracking and analyzing investments. You can create custom spreadsheets to monitor individual asset performance, calculate key metrics, and visualize data through charts and graphs.

Python:

For more advanced needs, Python offers libraries such as Pandas and NumPy for data manipulation and analysis, and Matplotlib for visualization. Python scripts can automate data retrieval and complex calculations, providing deeper insights into your portfolio.

External Tools:

Specialized software like Morningstar, Personal Capital, or Bloomberg Terminal offers comprehensive tracking and analysis features tailored for investors. These platforms provide real-time data, sophisticated analytics, and extensive reporting capabilities.

Conclusion

Incorporating advanced tracking tools into your investment strategy is not just a best practice; it’s a necessity for anyone serious about effective asset management. Whether you’re a novice investor or an experienced professional, these tools empower you to make informed decisions, manage risk effectively, and achieve your financial goals. By diligently tracking your investments, you ensure that your portfolio remains aligned with your strategic objectives, allowing you to navigate the complexities of the financial markets with confidence.

REFERENCES

Engage

To make our community even richer and more interactive, I invite you to participate actively! 🙌 Share the posts you find interesting, express your reactions, and don’t hesitate to leave a comment. Each of your actions helps spread financial knowledge to a wider audience. 📢💬

I am particularly interested in knowing your point of view: comment with your feedback, suggestions, or topics you would like to delve into. Your opinion is valuable for improving the content and offering insights more in line with your needs. 🔄🔍

Together, we can build a community where finance is accessible to everyone. Thank you for your support! 💖

Disclaimer 📜

Please note: The content shared across the channels reflects personal opinions and experiences. It is not intended as financial advice or an endorsement of specific strategies or products. 🚫

This information serves educational purposes only and should not be taken as professional financial guidance. Before making any financial decisions, we strongly recommend consulting with a qualified financial advisor. 📊➡️👨💼

KEYWORDS

#WatchlistTracker #InvestmentStrategy #StockMarket #RiskManagement #PortfolioManagement #FinancialPlanning #MarketAnalysis #InformedInvesting #InvestmentGoals #Diversification

Here my Investment tools

👇GitHub repository 👇

https://github.com/Anthony-Antona/Investment-Portfolio-tracker: Investment asset management tool

👇Download here the file👇

⚠️Upload it in google drive and

convert it as a google sheet to use all the formulas!