Estimated time to Read: 5 minutes 🕒

Investing in stocks can be both thrilling and daunting. One of the most perplexing questions for new and seasoned investors alike is, “How do you price a stock?” Understanding how to determine the value of a stock is essential for making informed investment decisions. Whether you’re aiming to grow your portfolio or simply want to avoid costly mistakes, this guide will break down the fundamentals of stock pricing in a way that’s accessible to everyone.

Understanding the Basics:

What Does It Mean to Price a Stock?

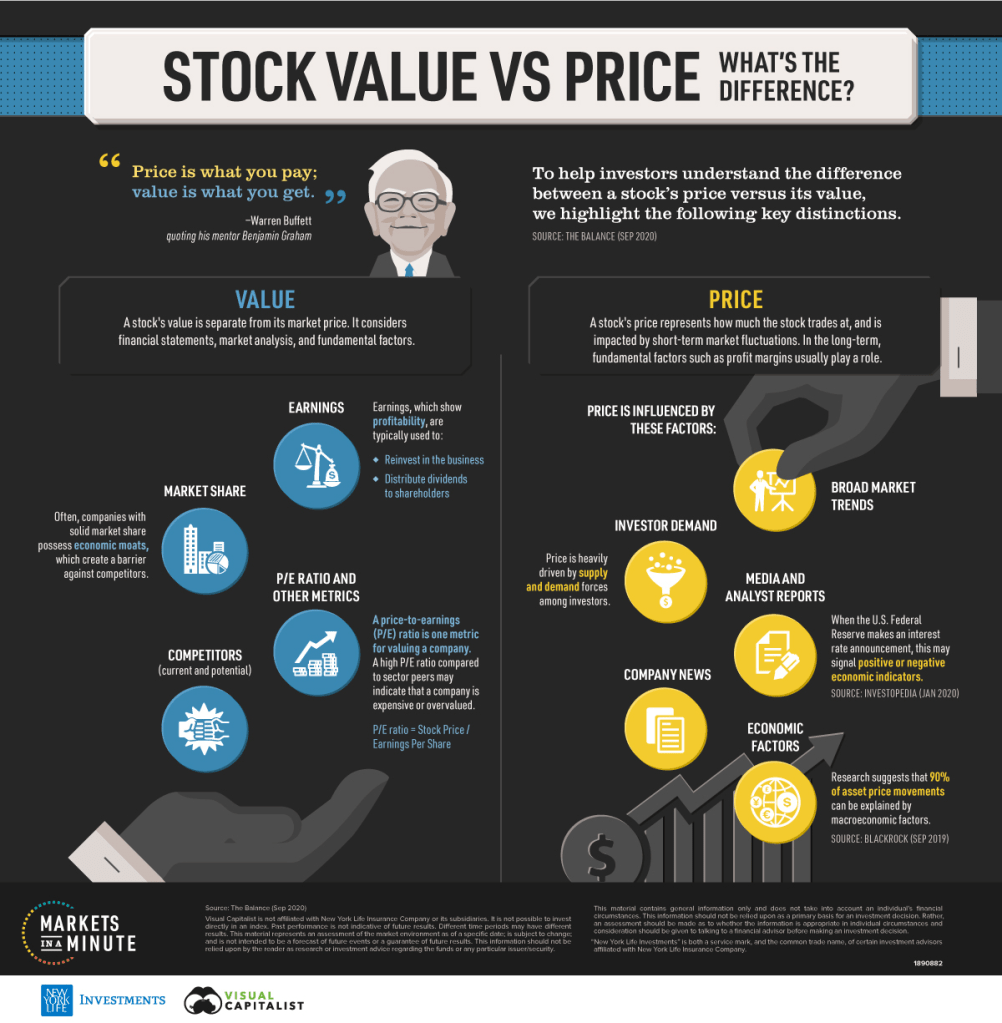

When we talk about pricing a stock, we’re referring to determining its intrinsic value—the true worth of the stock based on fundamental analysis, rather than just its current market price. The market price is what you see on the stock exchange, influenced by supply and demand, investor sentiment, and news. But the intrinsic value is what matters to savvy investors. It’s the value based on the company’s financial health, performance, and future growth prospects.

Key Factors in Stock Pricing

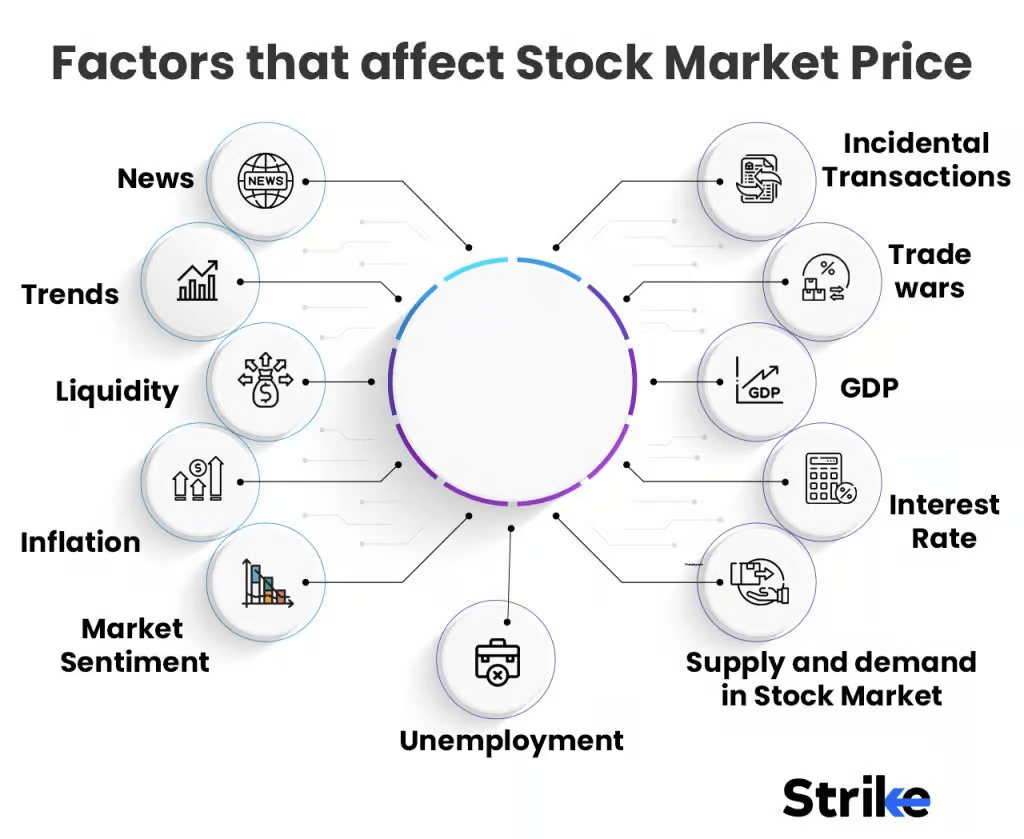

Several factors come into play when pricing a stock. Understanding these can give you an edge in the market:

- Earnings Per Share (EPS): This is the portion of a company’s profit allocated to each outstanding share. Higher EPS generally indicates better profitability and is often a sign of a potentially valuable stock.

- Price-to-Earnings Ratio (P/E Ratio): This ratio compares a company’s share price to its EPS. A high P/E might suggest that a stock is overvalued, or it could indicate that investors expect high future growth.

- Dividend Yield: For dividend-paying stocks, the dividend yield is the dividend per share divided by the stock price. This can be an attractive feature for income-focused investors.

- Discounted Cash Flow (DCF): This valuation method involves estimating the company’s future cash flows and discounting them back to their present value. It’s a comprehensive approach that factors in the time value of money.

- Market Sentiment and Trends: Investor sentiment, economic indicators, and market trends also significantly influence stock prices. Market psychology can often drive prices away from the stock’s intrinsic value.

Practical Strategies for Pricing a Stock

1. Fundamental Analysis: The Long-Term View

Fundamental analysis involves evaluating a company’s financial statements, management, competitive advantages, and market conditions. By assessing these elements, you can estimate whether a stock is undervalued, overvalued, or fairly valued. For example, if a company has strong earnings growth, low debt, and operates in a booming industry, it might be a good buy even if its P/E ratio is higher than the industry average.

2. Technical Analysis: The Short-Term Perspective

While fundamental analysis focuses on the intrinsic value, technical analysis looks at stock price movements and trading volumes to predict future price behavior. Technical analysts use charts and other tools to identify patterns that suggest future buying or selling opportunities.

3. Comparative Analysis: The Peer Benchmarking Method

Comparative analysis involves comparing a company’s financial metrics with those of similar companies in the same industry. This approach helps investors understand how a stock is valued relative to its peers. For instance, if a company’s P/E ratio is significantly lower than its industry average, it might be undervalued.

4. Using Financial Models: DCF and Beyond

Financial models, particularly the Discounted Cash Flow (DCF) model, are powerful tools for pricing a stock. The DCF model requires you to forecast the company’s free cash flows and discount them using a required rate of return to get the present value. This method is widely used by professional analysts and can provide a precise estimate of a stock’s intrinsic value.

Potential Risks and Challenges in Stock Pricing

Market Volatility

The stock market is inherently volatile, and prices can swing dramatically due to external factors like geopolitical events, economic data releases, or sudden changes in investor sentiment. This volatility can make it difficult to stick to your valuations, but maintaining a long-term perspective can help.

Over-Reliance on Models

While models like DCF are invaluable, they are based on assumptions that can be wrong. Overestimating future cash flows or underestimating risks can lead to incorrect valuations. It’s crucial to use these models as part of a broader investment strategy, not as the sole determinant.

Psychological Biases

Investors are often swayed by psychological biases, such as the tendency to follow the crowd (herd behavior) or hold on to losing stocks too long (loss aversion). Being aware of these biases and actively working to mitigate them is essential for making rational investment decisions.

REFERENCES

- Investopedia: “How to Value a Stock: What the Different Valuation Measures Mean” Link

- The Motley Fool: “Discounted Cash Flow Analysis” Link

- Books: “The Intelligent Investor” by Benjamin Graham

- Blogs: “Seeking Alpha” for advanced stock analysis and investing strategies

To make our community even richer and more interactive, I invite you to participate actively! 🙌

Share the posts you find interesting, express your reactions, and don’t hesitate to leave a comment. Each of your actions helps spread financial knowledge to a wider audience. 📢💬

I am particularly interested in knowing your point of view: comment with your feedback, suggestions, or topics you would like to delve into. Your opinion is valuable for improving the content and offering insights more in line with your needs. 🔄🔍

Together, we can build a community where finance is accessible to everyone. Thank you for your support! 💖

Disclaimer 📜

Please note: The content shared across the channels reflects personal opinions and experiences. It is not intended as financial advice or an endorsement of specific strategies or products. 🚫

This information serves educational purposes only and should not be taken as professional financial guidance. Before making any financial decisions, we strongly recommend consulting with a qualified financial advisor. 📊➡️👨💼

#StockValuation #FundamentalAnalysis #InvestmentStrategies #StockMarket #FinancialPlanning #ValueInvesting #MarketTrends #InvestmentTips