Estimated time to Read: 6 minutes 🕒

Have you ever felt lost in a sea of numbers when looking at a company’s financial report? You’re not alone. Understanding financial statements might seem like decoding a foreign language, but mastering this skill can unlock powerful insights into a company’s true health and future potential. Whether you’re an investor, a business owner, or simply someone who wants to be financially savvy, getting a grip on financial statements is your gateway to making smarter decisions.

Why Financial Statements Are Your Best Friend in Investing

Uncovering the Story Behind the Numbers

Financial statements are much more than a collection of numbers—they tell a story. They reveal how a company operates, how profitable it is, and where it’s headed. But to understand that story, you need to know how to read between the lines. Each financial statement—whether it’s the Balance Sheet, Income Statement, or Cash Flow Statement—serves as a chapter in this narrative, offering insights that go beyond the surface.

The Big Three:

Your Financial Statement Toolkit

Let’s break it down into manageable pieces:

- The Balance Sheet: The Snapshot of Financial Health

- The Balance Sheet gives you a snapshot of a company’s financial position at a specific moment in time. It lists assets (what the company owns), liabilities (what it owes), and shareholders’ equity (the residual interest in the company). Think of it as the company’s financial selfie.

- The Income Statement: The Profit and Loss Detector

- The Income Statement, also known as the Profit and Loss Statement, tracks how much money a company made (revenue) and how much it spent (expenses) over a specific period. It’s your go-to tool for understanding how effectively a company is converting sales into profit.

- The Cash Flow Statement: The Lifeblood of the Business

- Cash is king, and the Cash Flow Statement shows exactly how cash flows in and out of the business. It’s divided into operations, investing, and financing activities. This statement is crucial for assessing a company’s liquidity and financial flexibility—how well it can meet its obligations and invest in growth.

How to Use Financial Statements to Your Advantage

Spotting Investment Opportunities

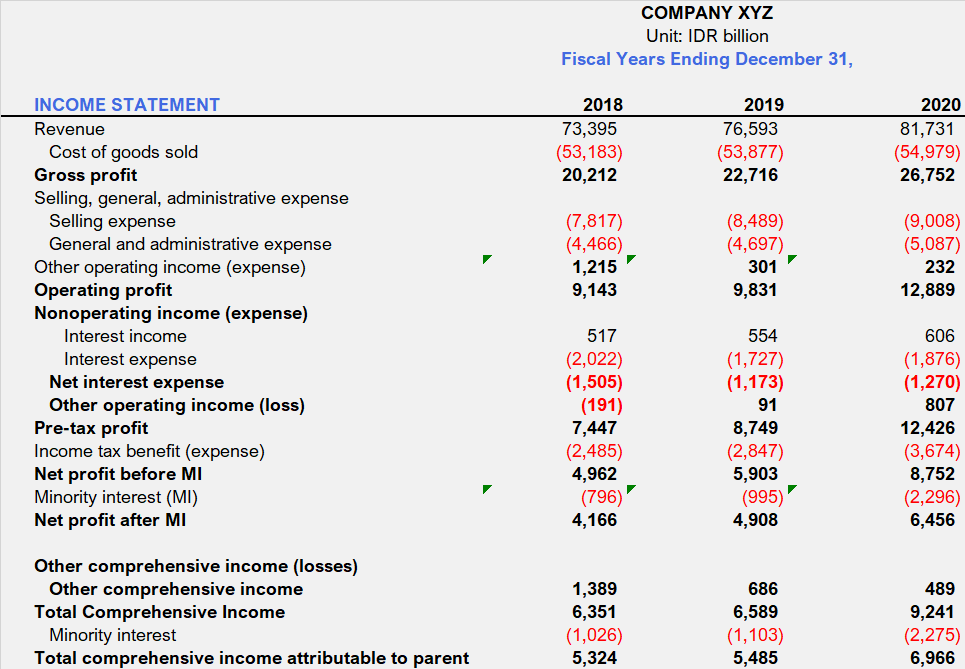

Financial statements are goldmines for finding undervalued stocks. By analyzing a company’s financials, you can determine whether it’s a hidden gem waiting to be discovered. Look at key ratios like the Price-to-Earnings (P/E) ratio, Return on Equity (ROE), and Debt-to-Equity ratio to get a quick sense of whether a company is performing well compared to its peers.

Protecting Yourself from Risk

On the flip side, these statements can also help you avoid potential disasters. Warning signs such as declining revenues, increasing debt, or inconsistent cash flows can indicate underlying problems that could affect the company’s future performance. Being able to identify these red flags early can save you from costly mistakes.

Beyond the Numbers: Understanding Context

It’s not just about what the numbers say—it’s about understanding the context in which they exist. Comparing financial statements over several years, benchmarking against competitors, and considering the broader economic environment are essential steps in making informed decisions.

Practical Tips for Navigating Financial Statements

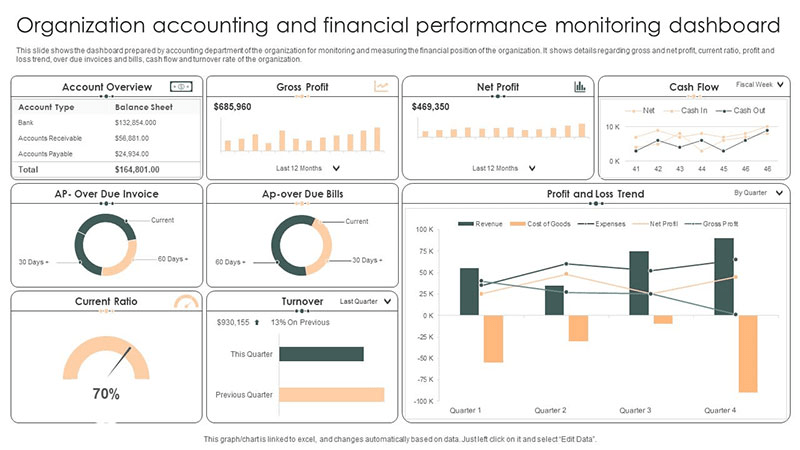

1. Start with the Overview

- Before diving into the details, take a step back and look at the big picture. What do the overall trends suggest? Are revenues growing? Is debt increasing? Getting a general sense of direction can guide your deeper analysis.

2. Focus on What Matters Most

- Don’t get bogged down by every line item. Focus on the sections that provide the most insight into profitability, liquidity, and financial stability. Key areas include net income, cash flow from operations, and total liabilities.

3. Use Ratios as Your Compass

- Financial ratios simplify complex information into digestible metrics. Use them to compare a company’s performance against industry standards and competitors. For example, a low P/E ratio compared to industry peers might suggest a potential bargain—if other fundamentals check out.

Risks and Challenges of Interpreting Financial Statements

Complexity and Misinterpretation

Financial statements can be complex, and without a solid understanding, it’s easy to misinterpret the data. Misreading the figures or relying too heavily on one metric can lead to poor investment choices.

The Risk of Manipulation

Be aware that companies sometimes use creative accounting techniques to paint a rosier picture than reality. This is where due diligence comes in—scrutinize the details, and look for consistency across different statements to verify the integrity of the information.

The Limits of Historical Data

Financial statements are historical records. While they provide invaluable insights, they may not fully reflect future challenges or opportunities. Always complement your analysis with forward-looking research and consider current market trends.

REFERENCES

- Investopedia: “Financial Statements” Link

- The Motley Fool: “How to Read Financial Statements” Link

- Books: “The Interpretation of Financial Statements” by Benjamin Graham

- Blogs: “Seeking Alpha” for in-depth analysis and investment tips

To make our community even richer and more interactive, I invite you to participate actively! 🙌

Share the posts you find interesting, express your reactions, and don’t hesitate to leave a comment. Each of your actions helps spread financial knowledge to a wider audience. 📢💬

I am particularly interested in knowing your point of view: comment with your feedback, suggestions, or topics you would like to delve into. Your opinion is valuable for improving the content and offering insights more in line with your needs. 🔄🔍

Together, we can build a community where finance is accessible to everyone. Thank you for your support! 💖

Disclaimer 📜

Please note: The content shared across the channels reflects personal opinions and experiences. It is not intended as financial advice or an endorsement of specific strategies or products. 🚫

This information serves educational purposes only and should not be taken as professional financial guidance. Before making any financial decisions, we strongly recommend consulting with a qualified financial advisor. 📊➡️👨💼

#FinancialStatements #InvestSmart #InvestmentTips #FinanceMadeEasy #UnderstandingFinance #BalanceSheet #IncomeStatement #CashFlow #StockMarket #InvestmentStrategy #FinancialLiteracy