Estimated time to Read: 8 minutes 🕒

Have you ever wondered how options are priced or why they fluctuate so much? Understanding the factors that influence option pricing can give you a significant edge in the world of trading and investment. Whether you’re looking to hedge your portfolio or profit from market volatility, knowing how to value options is essential for making informed decisions. In this post, we’ll break down the basics of option pricing and help you understand how it can impact your financial strategy.

What is Option Pricing?

Option pricing refers to the cost of purchasing an options contract, which grants the holder the right—but not the obligation—to buy or sell an asset at a predetermined price before a specified expiration date. There are two main types of options:

- Call options, which allow the holder to buy an asset at a certain price (the strike price).

- Put options, which give the holder the right to sell an asset at the strike price.

But how is the price of these options determined? Let’s dive into the factors that influence this pricing.

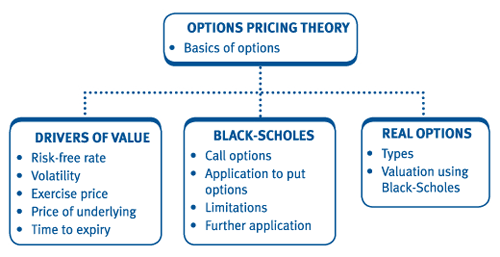

The Black-Scholes Model: The Gold Standard of Option Pricing

The most widely used model for pricing options is the Black-Scholes Model, developed in 1973, often referred to as the Black-Scholes-Merton model. This model calculates the theoretical price of European-style options (which can only be exercised at expiration) based on five key inputs:

- Current stock price: The price of the underlying asset.

- Strike price: The price at which the option can be exercised.

- Time until expiration: The remaining time before the option expires.

- Volatility: The expected fluctuation in the price of the underlying asset.

- Risk-free interest rate: The theoretical return on an investment with zero risk.

These variables work together to determine the “fair” value of an option. However, real-world factors like market sentiment and liquidity can cause the actual market price of an option to differ from the Black-Scholes price.

Explanation of How It Works:

- St (current stock price) represents the current value of the stock.

- X (strike price) is the fixed price at which the option holder can buy or sell the stock.

- t (time to expiration) captures the remaining time before the option expires, influencing how much potential movement the stock price can experience.

- r (risk-free rate) accounts for the theoretical return from a zero-risk investment, like government bonds, used to discount the future cash flow from the option.

- σ\sigma (volatility) represents how much the stock price fluctuates over time. Higher volatility leads to higher option prices because of the increased probability of large price swings in the stock.

Key Functions:

- N(d1) and N(d2): These are probabilities from the standard normal distribution, which reflect the likelihood that the option will expire in-the-money. They allow for a probabilistic assessment of the option’s potential value at expiration.

- The formula for d1: It calculates the expected return on the stock relative to the risk-free rate and adjusted for the stock’s volatility. The higher the expected stock price in relation to the strike price, the more valuable the call option becomes.

- The formula for d2: This modifies d1d_1d1 to account for the actual time value of the option, incorporating the volatility and remaining time to expiration.

How the Formula Works:

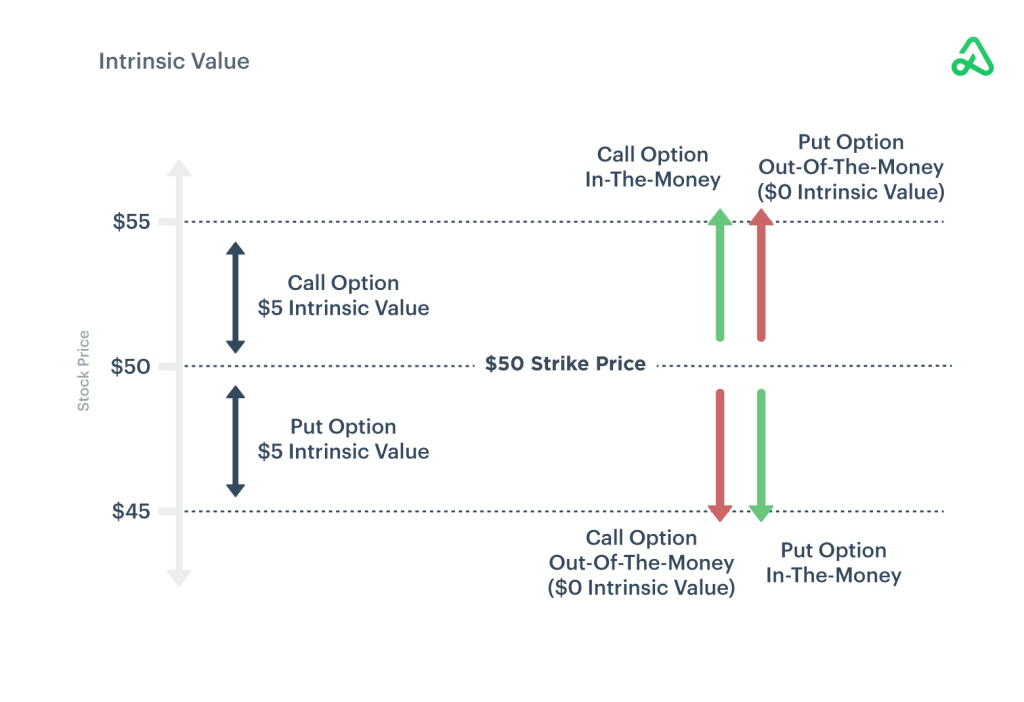

- Intrinsic Value: If the stock price is higher than the strike price (for a call option), the option has intrinsic value.

- Time Value: The longer the time to expiration, the more time the stock has to potentially reach a profitable level, thus increasing the option’s price. This is factored into the model through the TTT term.

- Volatility: Higher volatility means more uncertainty about the future price of the stock, which increases the likelihood that the option will become profitable before expiration. This is why more volatile stocks tend to have higher option prices.

While the model provides a powerful tool to estimate an option’s theoretical value, it’s important to understand that it assumes constant volatility and a risk-free rate, both of which can fluctuate in real-world markets. Hence, it provides a baseline that traders may adjust based on market sentiment and additional real-world factors like liquidity.

In practice, the Black-Scholes model is widely used by traders and financial analysts to price options, but it is also a foundational building block for more complex option-pricing models that account for the complexities of real-world financial markets.

Key Factors Influencing Option Prices

- Intrinsic Value vs. Time Value

- Intrinsic value is the difference between the underlying asset’s current price and the option’s strike price. For example, if a stock is trading at $100 and you own a call option with a strike price of $90, the intrinsic value is $10.

- Time value represents the additional amount traders are willing to pay due to the potential for the option to increase in value before expiration. The longer the time until expiration, the higher the time value.

- Volatility

- Volatility is one of the most critical factors in option pricing. The higher the volatility of the underlying asset, the greater the potential for price swings, making the option more expensive due to increased uncertainty.

- Interest Rates

- Changes in risk-free interest rates (like those from government bonds) can impact the prices of options.

- When interest rates go up, call options (the right to buy a stock) usually become more expensive. This is because it’s better to invest money in something safe that pays interest, so the opportunity to buy a stock in the future becomes more valuable.

- On the other hand, put options (the right to sell a stock) usually become cheaper when interest rates are higher. This is because, with attractive interest rates, people are less interested in selling stocks and prefer to hold investments that earn guaranteed interest.

In short, higher interest rates make it more costly to buy call options but make put options less expensive.

- Changes in risk-free interest rates (like those from government bonds) can impact the prices of options.

- Dividend Payments

- For options on dividend-paying stocks, the anticipated dividend payment can lower the price of call options and increase the price of put options, as the value of the underlying stock is expected to drop by the dividend amount on the ex-dividend date.

How to Use Option Pricing in Your Investment Strategy

Hedging Your Portfolio

One of the primary uses of options is hedging. For example, if you hold a stock that you believe may decline in the short term, you can buy put options to protect against losses. If the stock price drops, the increase in the value of your put options can offset some or all of the decline in your stock holdings.

Generating Income

Another popular strategy is selling covered calls, where you sell call options against a stock you already own. This allows you to collect the option premium, generating additional income on top of any dividends or capital gains from the stock itself.

When you use a covered call strategy, you sell a call option on a stock that you already own. A call option gives the buyer the right to buy the stock from you at a set price (called the strike price) by a specific date.

Here’s how it works:

- You already own the stock: Let’s say you own shares of a company.

- You sell a call option: You sell a call option to someone else. They pay you a fee (called a premium) for the option to buy the stock from you at a set price.

- You keep the premium: Whether or not the buyer ends up buying your stock, you keep the premium as extra income.

Possible Outcomes:

- If the stock price doesn’t go up much or stays the same: The option will likely expire unused. In this case, you keep both the premium you collected and your stock. You can repeat the process and keep earning income.

- If the stock price goes up a lot: The buyer might exercise the option, meaning they buy your stock at the strike price. You’ll have to sell it at that price, even if the stock is worth more in the market. However, you still get to keep the premium and any gains on the stock up to the strike price.

Why use this strategy?

It’s a way to earn extra money on a stock you already own, especially if you think the stock price won’t go up too much in the near future. However, you might miss out on bigger profits if the stock price rises sharply.

In short, selling covered calls is a way to earn additional income from your stock by selling call options while keeping any dividends or potential gains up to a certain point.

Speculating on Volatility

For more aggressive investors, options can be used to speculate on the volatility of a stock or index. If you expect a significant price movement but are unsure of the direction, you can buy both a call and a put option (a strategy known as a straddle) to profit from the volatility regardless of which way the market moves.

Risks and Challenges of Option Pricing

Time Decay

One of the biggest challenges with options is time decay. As an option approaches its expiration date, the time value decreases, which can lead to a loss in value even if the stock moves in the right direction.

Leverage and Risk

Options offer leverage, meaning small changes in the price of the underlying asset can lead to significant gains or losses. This leverage can amplify both profits and risks, so it’s crucial to manage your exposure carefully.

Market Conditions

Unexpected events or market conditions can cause drastic changes in option prices. Even well-calculated strategies can be affected by external factors such as economic reports, geopolitical events, or sudden shifts in market sentiment.

REFERENCES

- Investopedia: “What are Options” Link

- The Motley Fool: “Options” Link

- Books: “Options, Futures, and Other Derivatives” by John Hull

- CBOE (Chicago Board Options Exchange): “Options Pricing” Link

To make our community even richer and more interactive, I invite you to participate actively! 🙌

Share the posts you find interesting, express your reactions, and don’t hesitate to leave a comment. Each of your actions helps spread financial knowledge to a wider audience. 📢💬

I am particularly interested in knowing your point of view: comment with your feedback, suggestions, or topics you would like to delve into. Your opinion is valuable for improving the content and offering insights more in line with your needs. 🔄🔍

Together, we can build a community where finance is accessible to everyone. Thank you for your support! 💖

Disclaimer 📜

Please note: The content shared across the channels reflects personal opinions and experiences. It is not intended as financial advice or an endorsement of specific strategies or products. 🚫

This information serves educational purposes only and should not be taken as professional financial guidance. Before making any financial decisions, we strongly recommend consulting with a qualified financial advisor. 📊➡️👨💼

#OptionsTrading #OptionPricing #BlackScholes #InvestmentStrategies #Volatility #FinancialPlanning #RiskManagement #Derivatives #Finance101 #SmartInvesting