Estimated time to Read: 5 minutes 🕒

If you’re looking to invest in bonds, understanding how they are priced is critical to making a sound financial decision. Bond pricing can seem complex, but once you grasp the key concepts, you’ll be able to evaluate whether a bond fits your portfolio and offers the return you expect. Let’s break down the essentials of bond pricing and what factors you need to consider before buying a bond.

INTRODUCTION

What is Bond Pricing and Why is it Important?

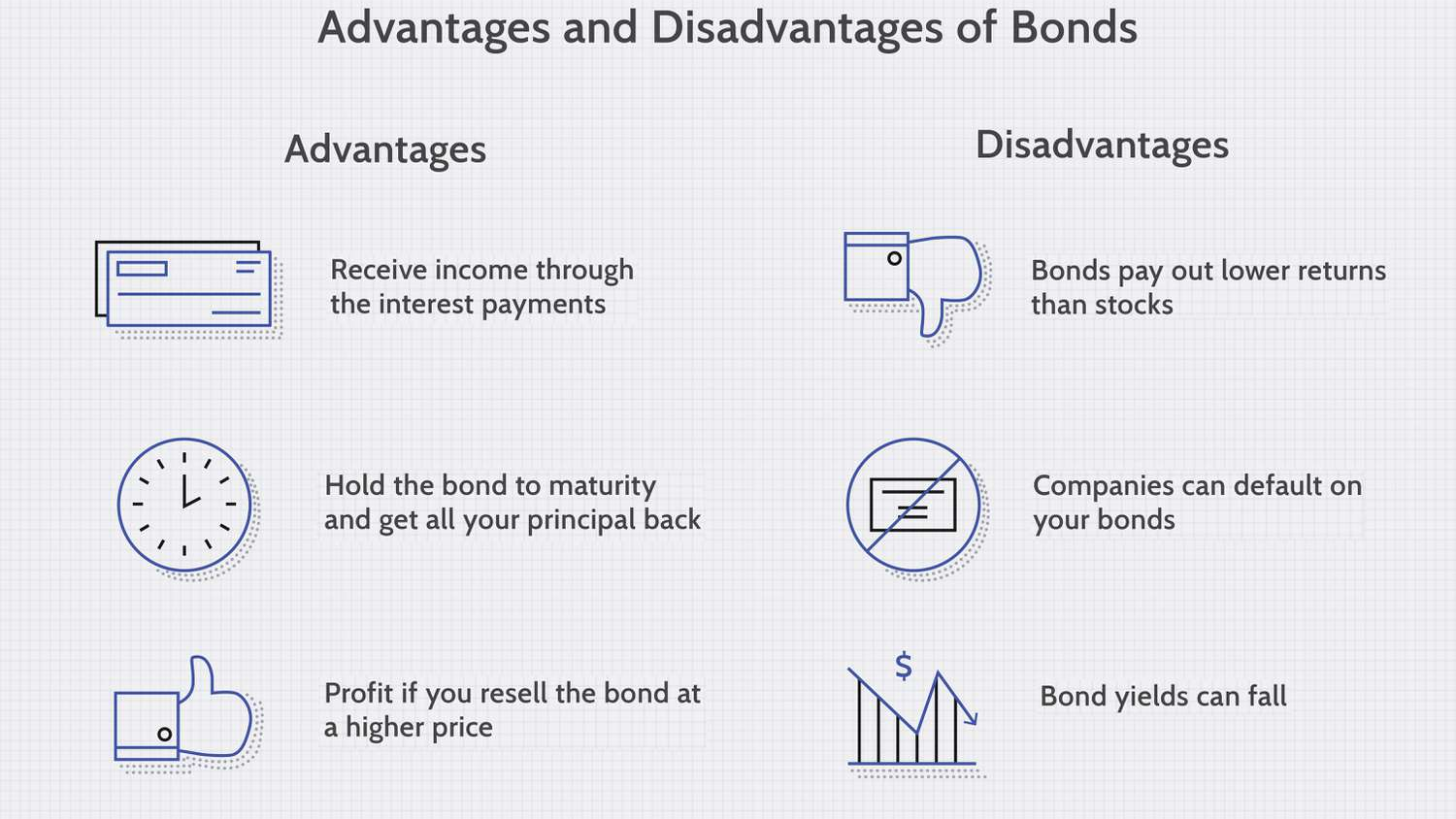

Bond pricing is essentially the present value of its future cash flows, which include the coupon payments (interest) and the repayment of the face value at maturity. Unlike stocks, bonds are debt securities, and their prices fluctuate based on several factors such as interest rates, the creditworthiness of the issuer, and the time to maturity.

Understanding bond pricing helps investors gauge whether a bond is overvalued or undervalued, thus enabling more informed buying decisions. For example, did you know that when interest rates rise, bond prices fall? This inverse relationship is one of the key reasons why bond pricing can fluctuate in the market.

CONTENT

Key Factors Influencing Bond Prices

- Interest Rates: The relationship between bond prices and interest rates is inverse. When rates go up, bond prices tend to fall and vice versa. Why? If new bonds are issued at higher interest rates, the old bonds, which pay lower rates, become less attractive, driving down their price.

- Time to Maturity: The longer a bond’s maturity, the more sensitive it is to interest rate changes. Bonds with longer durations face more uncertainty, and hence their prices fluctuate more compared to shorter-term bonds.

- Credit Rating: Bonds are rated by agencies like Moody’s or S&P, and the issuer’s creditworthiness affects the bond’s price. Bonds from issuers with lower credit ratings must offer higher yields to compensate for the increased risk of default.

- Coupon Rate: The coupon rate (the bond’s interest payment) is a major factor. A bond with a higher coupon rate than current market interest rates will generally sell at a premium, while bonds with lower coupon rates may sell at a discount.

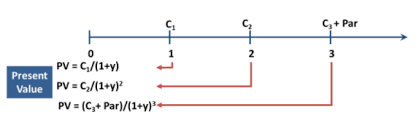

How to Calculate Bond Prices

To calculate the price of a bond, you need to find the present value of its future coupon payments and the face value (the amount paid back at maturity). The formula for calculating bond price takes into account:

- Coupon payments (periodic interest payments)

- Face value (principal to be repaid at maturity)

- Discount rate (market interest rate)

Here’s a basic formula for bond pricing:

Bond Price = C × [1 − (1 + r)^−n] / r + F / (1 + r)^n

Where:

- C = Coupon payment

- r = Discount rate (market interest rate)

- n = Number of periods until maturity

- F = Face value

Real-World Example

Let’s say you’re looking at a bond with a face value of $1,000, a coupon rate of 5%, and 10 years to maturity. If the current market interest rate is 3%, you would calculate the present value of the coupon payments (5% annually) and the face value to find out if it’s a good buy.

Strategies to Leverage Bonds in Your Portfolio

- Diversification: Bonds can be a stable part of a diversified portfolio, balancing out the volatility of equities.

- Yield to Maturity (YTM): Calculate this to understand the total return you’ll earn if you hold the bond until it matures.

- Duration Matching: Align your bond investments with your financial goals by matching the bond’s duration with when you’ll need the capital.

Potential Risks and Challenges

Interest Rate Risk

As mentioned earlier, rising interest rates can hurt bond prices. If you buy a bond and rates rise, the value of your bond may drop, especially if you decide to sell it before maturity.

Credit Risk

Not all bonds are created equal. Bonds from lower-rated companies (junk bonds) offer higher yields but come with a much higher risk of default. Always consider the issuer’s financial health before purchasing.

Liquidity Risk

Some bonds, especially those from smaller companies or less liquid markets, may be harder to sell if you need cash quickly. Make sure to consider liquidity when selecting bonds for your portfolio.

Part 4: REFERENCES

- Investopedia: “Bonds: How they work” Link

- The Motley Fool: “What they are and how to invest” Link

- Books: “The Bond Book” by Annette Thau

CONCLUSION

To make our community even richer and more interactive, I invite you to participate actively! 🙌

Share the posts you find interesting, express your reactions, and don’t hesitate to leave a comment. Each of your actions helps spread financial knowledge to a wider audience. 📢💬

I am particularly interested in knowing your point of view: comment with your feedback, suggestions, or topics you would like to delve into. Your opinion is valuable for improving the content and offering insights more in line with your needs. 🔄🔍

Together, we can build a community where finance is accessible to everyone. Thank you for your support! 💖

Disclaimer 📜

Please note: The content shared across the channels reflects personal opinions and experiences. It is not intended as financial advice or an endorsement of specific strategies or products. 🚫

This information serves educational purposes only and should not be taken as professional financial guidance. Before making any financial decisions, we strongly recommend consulting with a qualified financial advisor. 📊➡️👨💼

Keywords and Hashtags: #BondPricing #FixedIncome #InvestmentStrategies #InterestRates #DiversifyYourPortfolio #FinancialPlanning #InvestmentTips #WealthBuilding #Bonds #RiskManagement #FinancialEducation #CFA