Estimated time to Read: 9 minutes 🕒

Introduction

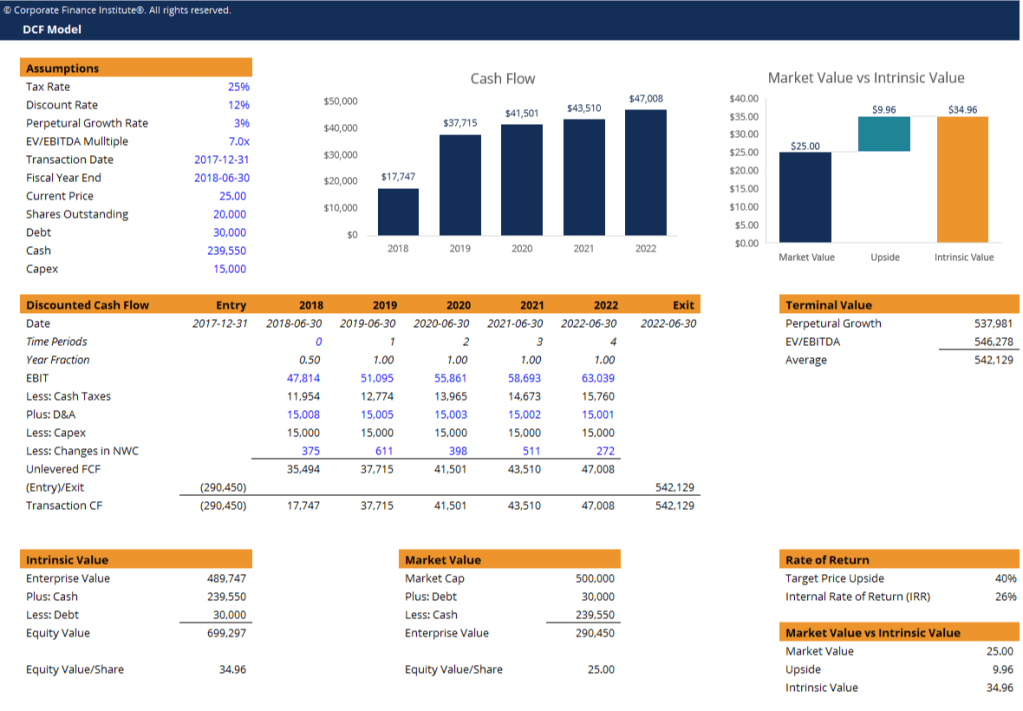

In the world of finance and investment, accurately determining the value of a company or asset is crucial. One of the most reliable and widely used methods for valuation is the Discounted Cash Flow (DCF) method. This technique is fundamental for investors, analysts, and financial professionals aiming to make informed decisions based on the intrinsic value of an investment. In this comprehensive guide, we’ll delve deep into the DCF method, explaining its principles, steps, advantages, and limitations.

What is the Discounted Cash Flow (DCF) Method?

The Discounted Cash Flow (DCF) method is a valuation technique used to estimate the value of an investment based on its expected future cash flows. By projecting these cash flows and discounting them back to their present value, the DCF method provides an intrinsic value that investors can compare against the current market value to make investment decisions.

Why is DCF Important in Valuation?

- Intrinsic Value Assessment: DCF helps in determining the true value of an investment, independent of market conditions or external factors.

- Investment Decisions: Investors use DCF to decide whether an investment is overvalued or undervalued.

- Corporate Finance: Companies employ DCF analysis for capital budgeting and to evaluate potential mergers and acquisitions.

The Fundamental Concept: Time Value of Money

At the heart of the DCF method lies the time value of money (TVM) principle, which states that a dollar today is worth more than a dollar in the future due to its earning potential. DCF applies this concept by discounting future cash flows to present value terms.

How the DCF Method Works: A Step-by-Step Guide

To calculate the DCF, you’ll follow these key steps:

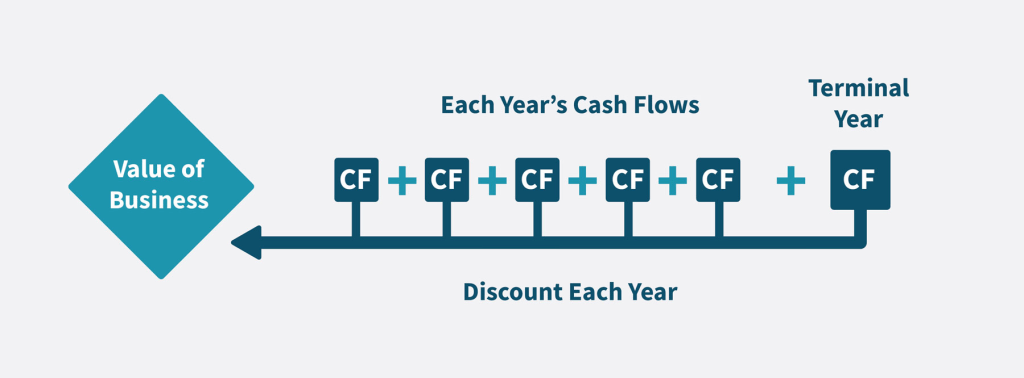

- Sum the Present Values: Add up the present values of all forecasted cash flows and the terminal value to get the enterprise value. To arrive at the equity value, subtract net debt from the enterprise value. Divide this figure by the number of outstanding shares to get the intrinsic value per share.

- Forecast Future Cash Flows: Start by estimating the company’s free cash flows over a specific period (usually 5-10 years). Free cash flow is the cash a company generates after accounting for capital expenditures and operating expenses. Look at past performance, industry trends, and market conditions to project realistic figures.

- Determine the Terminal Value: After the forecast period, assume the company will continue to generate cash indefinitely. The terminal value represents this continuation. A common approach is the “perpetual growth model,” which assumes cash flows will grow at a constant rate forever.

- Select a Discount Rate: The discount rate reflects the opportunity cost of investing your money elsewhere and accounts for risk. It’s typically the company’s Weighted Average Cost of Capital (WACC), representing the blended cost of equity and debt. A higher discount rate reflects more risk, reducing the present value of future cash flows.

- Calculate Present Value: Use the discount rate to bring the future cash flows and terminal value back to their present value. This step is crucial because it adjusts for the time value of money, reflecting that cash received in the future is worth less than cash received today.

Detailed Explanation of Each Step

Forecasting Free Cash Flows

Free Cash Flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets.

Formula: FCF=Operating Cash Flow−Capital Expenditures

Key Considerations:

- Revenue Growth: Analyze historical trends and industry outlook to project future revenues.

- Expenses: Consider cost of goods sold (COGS), operating expenses, and taxes.

- Working Capital: Include changes in accounts receivable, inventory, and accounts payable.

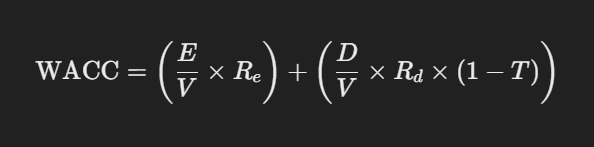

Determining the Discount Rate (WACC)

The Weighted Average Cost of Capital (WACC) represents the average rate of return a company is expected to pay its security holders.

Formula:

Where:

- E = Market value of equity

- D = Market value of debt

- V = E+DE + DE+D

- Re = Cost of equity

- Rd = Cost of debt

- T = Corporate tax rate

Calculating the Terminal Value

The Terminal Value (TV) accounts for future cash flows beyond the projection period.

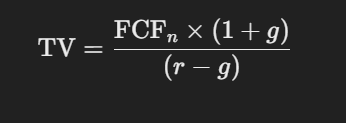

Gordon Growth Model Formula:

Where:

- FCFn = Free cash flow in the final forecasted year

- g = Perpetual growth rate

- r = Discount rate (WACC)

Discounting Cash Flows to Present Value

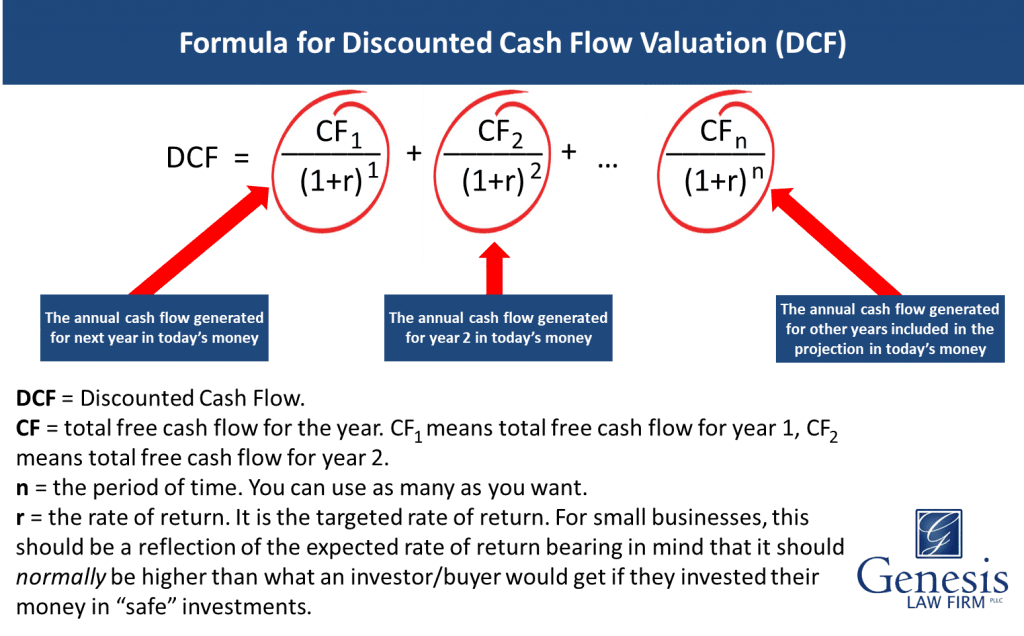

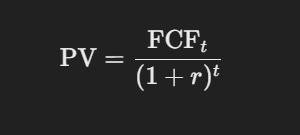

Each projected cash flow is discounted back to its present value using the discount rate.

Formula:

Where:

- FCFt = Free cash flow in year t

- r = Discount rate

- t = Year number

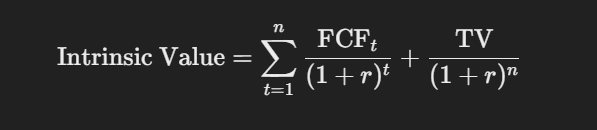

Summing Up to Get the Intrinsic Value

Add all the present values of projected free cash flows and the present value of the terminal value.

Formula:

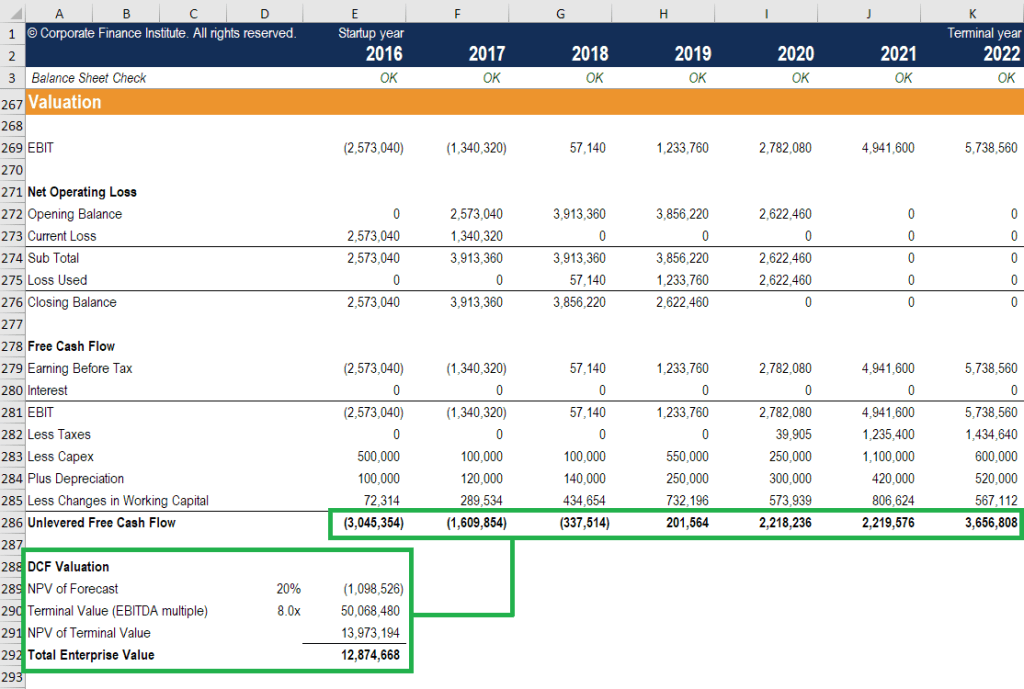

Practical Example

Let’s assume Company XYZ has projected FCFs for the next 5 years:

- Year 1: $100 million

- Year 2: $110 million

- Year 3: $121 million

- Year 4: $133 million

- Year 5: $146 million

Assumptions:

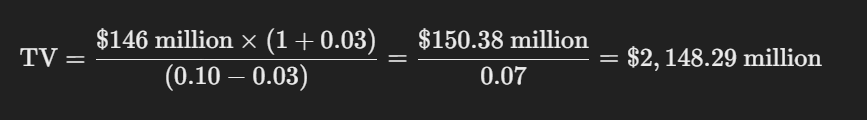

- WACC (Discount Rate): 10%

- Perpetual Growth Rate: 3%

Calculations:

- Calculate Terminal Value:

- Discount FCFs and TV to Present Value:

| Year | FCF ($ million) | PV Factor (10%) | PV of FCF ($ million) |

|---|---|---|---|

| 1 | 100 | 0.9091 | 90.91 |

| 2 | 110 | 0.8264 | 90.90 |

| 3 | 121 | 0.7513 | 90.91 |

| 4 | 133 | 0.6830 | 90.90 |

| 5 | 146 | 0.6209 | 90.91 |

| TV | 2,148.29 | 0.6209 | 1,333.49 |

| Total | 1,787.02 |

Intrinsic Value of Company XYZ is approximately $1,787.02 million.

Advantages of the DCF Method

- Focus on Fundamentals: Relies on underlying financial performance rather than market sentiment.

- Flexibility: Can be tailored to different scenarios and assumptions.

- Comprehensive: Considers all aspects of future cash flows and their present value.

Limitations of the DCF Method

- Sensitive to Assumptions: Small changes in inputs can significantly affect the valuation.

- Forecasting Challenges: Difficult to predict future cash flows accurately.

- Complexity: Requires a deep understanding of financial modeling and valuation techniques.

Common Mistakes in DCF Analysis

- Overly Optimistic Projections: Overestimating future cash flows can lead to inflated valuations.

- Incorrect Discount Rate: Using an inappropriate discount rate skews the results.

- Ignoring Macro Factors: Failing to account for economic conditions and industry trends.

Conclusion

The Discounted Cash Flow method is a powerful tool for valuing investments based on their intrinsic worth. By understanding and accurately applying the DCF method, investors and financial professionals can make informed decisions, ensuring they invest in assets that offer true value. Despite its limitations, when used correctly, DCF remains an essential component of financial analysis and investment strategy.

Frequently Asked Questions (FAQs)

1. What is the main purpose of the DCF method?

The DCF method aims to determine the intrinsic value of an investment by discounting its expected future cash flows to present value, helping investors assess whether an asset is undervalued or overvalued.

2. How does the discount rate affect the DCF valuation?

The discount rate reflects the investment’s risk and opportunity cost. A higher discount rate reduces the present value of future cash flows, resulting in a lower valuation, and vice versa.

3. Can DCF be used for all types of investments?

While DCF is versatile, it’s most effective for investments with predictable and stable cash flows. It’s less reliable for valuing startups or companies with volatile earnings.

4. difference between FCFF and FCFE?

- FCFF or free cash flow to the firm represents cash flows available to all capital providers (both debt and equity holders).

- FCFE or free cash flow to equity represents cash flows available only to equity shareholders after accounting for debt payments.

5. How often should a DCF analysis be updated?

A DCF analysis should be updated whenever there are significant changes in the company’s operations, financial performance, or market conditions that affect future cash flow projections.

REFERENCES

- Investopedia Link

- The Motley Fool Link

- Books: “Valuation: Measuring and Managing the Value of Companies” by McKinsey & Company

CONCLUSION

To make our community even richer and more interactive, I invite you to participate actively! 🙌

Share the posts you find interesting, express your reactions, and don’t hesitate to leave a comment. Each of your actions helps spread financial knowledge to a wider audience. 📢💬

I am particularly interested in knowing your point of view: comment with your feedback, suggestions, or topics you would like to delve into. Your opinion is valuable for improving the content and offering insights more in line with your needs. 🔄🔍

Together, we can build a community where finance is accessible to everyone.

Thank you for your support! 💖

Disclaimer 📜

Please note: The content shared across the channels reflects personal opinions and experiences. It is not intended as financial advice or an endorsement of specific strategies or products. 🚫

This information serves educational purposes only and should not be taken as professional financial guidance. Before making any financial decisions, we strongly recommend consulting with a qualified financial advisor. 📊➡️👨💼

KEYWORDS AND HASHTAGS

DiscountedCashFlow #DCFAnalysis #CompanyValuation #IntrinsicValue #InvestmentStrategies #FinancialModeling #Investing101 #FinancialAnalysis #ValueInvesting #StockValuation #InvestmentRisks #CashFlowProjection #LongTermInvesting #FinanceEducation