Estimated time to Read: 7 minutes 🕒

Welcome to the journey through the world of pension systems! Whether you’re just starting your career or eyeing the horizon of retirement, understanding pensions is key to unlocking financial security in your golden years. So, grab a cup of coffee, and let’s demystify this crucial aspect of financial planning together. ☕️

What is a Pension System, Anyway?

At its core, a pension system is a type of savings plan designed to offer people a stable income after they retire from their careers. Think of it as your financial safety net, ensuring you can maintain a comfortable lifestyle when you’re no longer working.

Pensions are more than just a personal or company perk; they’re a fundamental component of social security systems in many countries. They ensure that, as people age, they have the financial resources they need to support themselves, reducing dependency on family or state welfare.

The Spectrum of Pension Schemes

Pension systems can broadly be classified into two categories: public and private pension schemes.

- Public Pension Schemes: Funded and managed by the government, these are often mandatory, providing a safety net for all citizens or residents in retirement.

- Private Pension Schemes: Offered by employers or available for individual setup, these plans allow for additional savings beyond what the state provides.

Within these categories, you’ll encounter two main types of plans:

- Defined Benefit Plans: The holy grail for retirees, offering a guaranteed payout at retirement, calculated based on salary and years of service.

- Defined Contribution Plans: More like a financial adventure, where the amount you receive depends on how much was contributed and how well the investments performed.

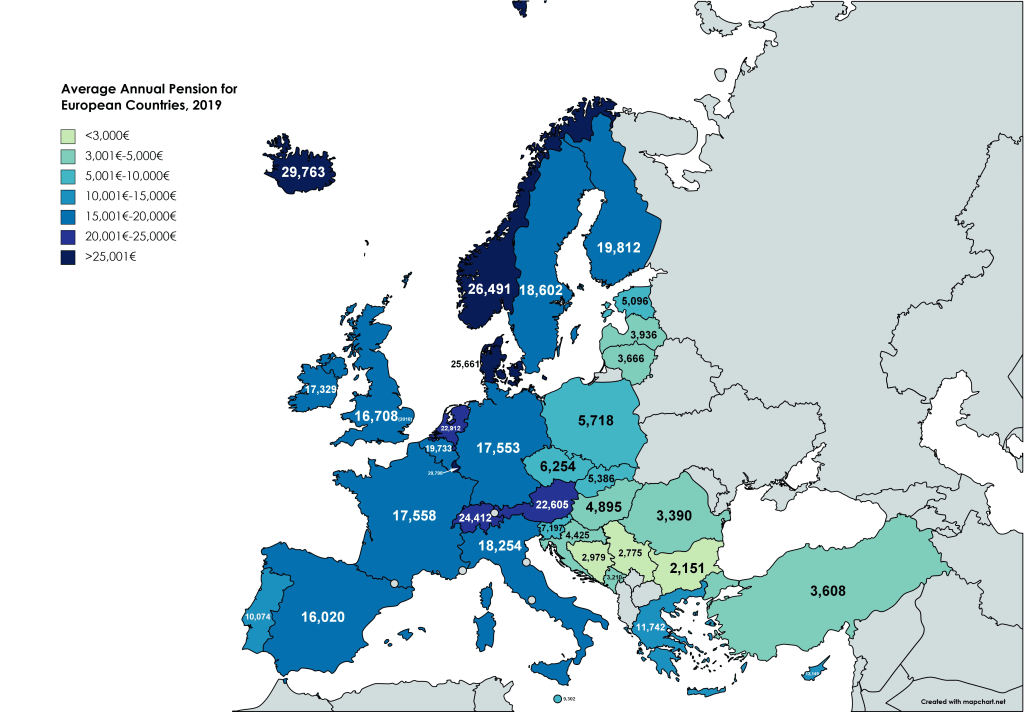

The pension landscape in Europe and other major economies worldwide reflects diverse approaches to ensuring financial security for retirees. As countries face demographic shifts, economic pressures, and evolving labor markets, pension systems are continuously being reformed and adapted. Let’s explore the pension systems in Italy, Portugal, Spain, and revisit the previously mentioned countries, incorporating the latest developments as of my last update in April 2023.

Europe’s Pension Landscape

- Italy: Italy’s pension system is predominantly public, financed through a pay-as-you-go (PAYG) scheme. The system has undergone several reforms to ensure its sustainability, focusing on increasing the retirement age and linking benefits more closely to lifetime contributions. Despite these efforts, demographic challenges and economic strains continue to necessitate further adjustments.

- Portugal: The Portuguese pension system combines a public PAYG scheme with voluntary private savings. The public component is based on earnings and contribution periods, with recent reforms aimed at enhancing the system’s sustainability by adjusting the retirement age and contribution requirements in response to demographic changes.

- Spain: Spain’s pension system relies on a PAYG model, where current workers’ contributions fund retirees’ pensions. Faced with one of Europe’s most rapidly aging populations, Spain has enacted reforms to gradually increase the retirement age and introduce sustainability factors to adjust pensions based on life expectancy and economic conditions.

- Sweden: Sweden’s multi-pillar approach includes a public pension based on income, a mandatory funded pension, and voluntary private pensions. The system is designed for long-term sustainability, with benefits that adjust according to demographic and economic conditions.

- France: France’s primarily public pension system is funded by employer and employee contributions. Financial pressures from an aging population have led to proposed reforms, including adjustments to the retirement age and the period of contributions required for a full pension.

- Germany: The German pension system features a PAYG mechanism, with recent reforms introducing subsidized private retirement plans (“Riester” pensions) to supplement public pensions. Benefits are based on earnings and the number of years contributed.

- United Kingdom: The UK combines a public State Pension with private pensions, the latter encouraged through auto-enrolment workplace schemes. The State Pension age has been increasing to reflect higher life expectancies.

Other Key Global Economies

- United States: The US features Social Security and employer-sponsored plans like 401(k)s and IRAs. Social Security provides retirement, disability, and survivors benefits, while private plans encourage individual retirement savings.

- Japan: Japan’s aging population poses a significant challenge to its PAYG public pension system. Reforms aim to increase the retirement age and promote longer workforce participation, supplemented by employee pension plans and private savings.

- China: China’s system includes a basic public pension for urban workers and mandatory and voluntary employer-sponsored plans. The country faces challenges related to rapid aging and urbanization.

- India: Moving from traditional family support, India’s National Pension System (NPS) is a voluntary, defined contribution scheme aimed at creating a pensioned society, reflecting the country’s evolving approach to retirement savings.

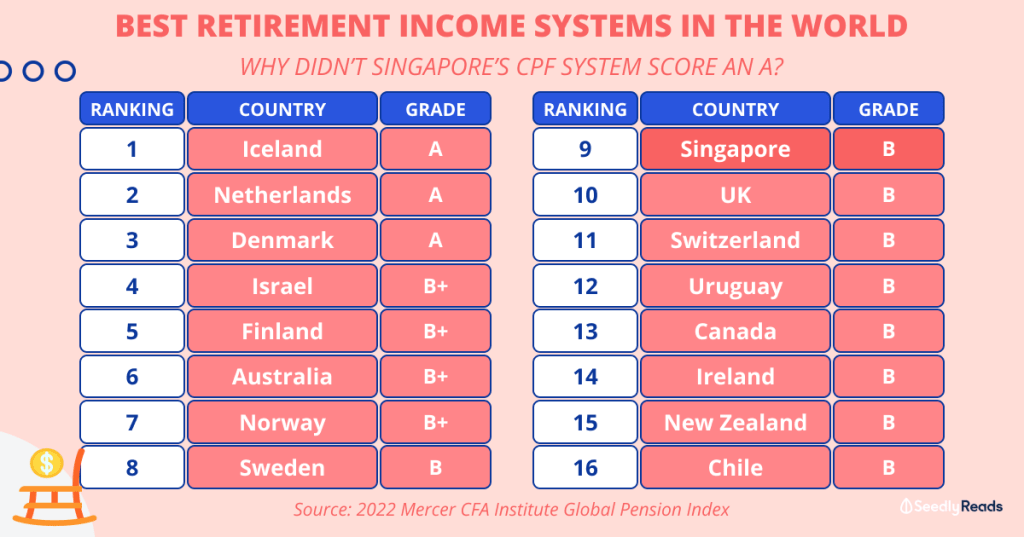

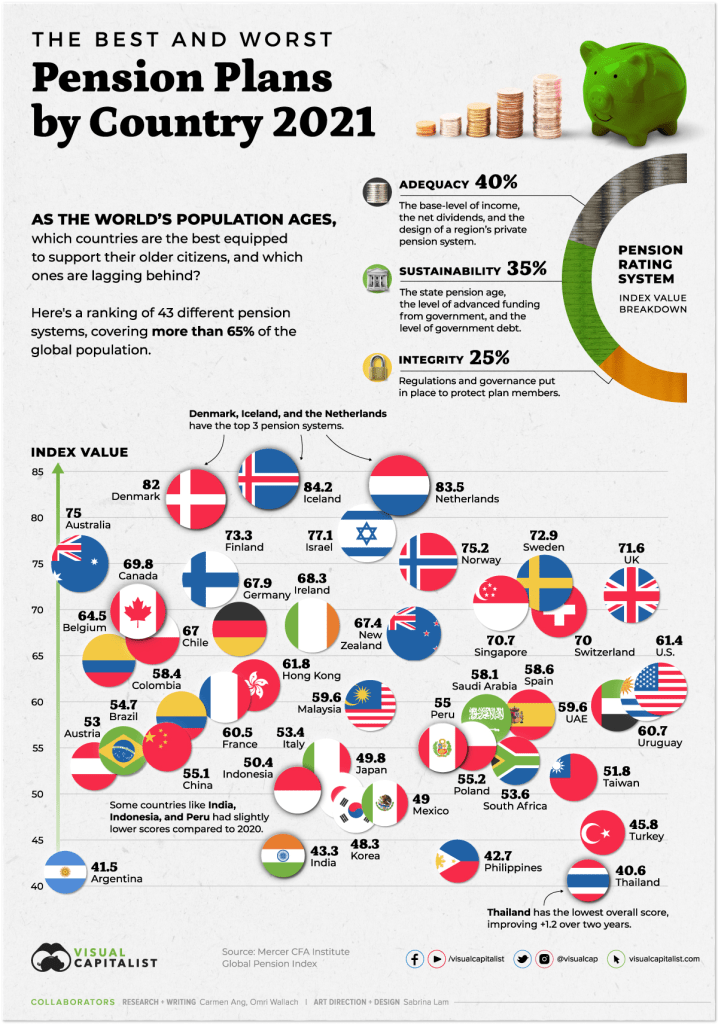

A Global Perspective

From the bustling streets of New York to the serene landscapes of Sweden, pension systems vary dramatically. For example, the Nordic model, known for its generous public pension schemes, contrasts with the more mixed approach in the United States, where private retirement savings options like 401(k)s play a significant role.

Countries like Chile and Australia have been pioneers in implementing mandatory private pension systems, showcasing innovative approaches to retirement savings.

Navigating Challenges

- Aging Populations: With people living longer, there’s increased pressure on pension funds to provide for longer retirement periods.

- Economic Volatility: Market fluctuations can impact the investment returns that pension funds rely on to pay out benefits.

- Sustainability Concerns: As the ratio of workers to retirees decreases, ensuring that pension systems remain funded is a growing challenge.

Planning for Your Retirement

In this landscape, how can you secure your financial future? Here are a few strategies:

- Start Early: The sooner you begin saving for retirement, the more time your money has to grow.

- Diversify: Don’t put all your eggs in one basket. A mix of pension schemes, personal savings, and investments can provide a more secure retirement.

- Stay Informed: Government policies and pension regulations change. Keeping abreast of these changes can help you make better planning decisions.

Innovations and Reforms

Globally, we’re seeing exciting reforms and innovations in pension systems. Technology is making it easier for individuals to track and manage their retirement savings, while some countries are exploring hybrid models that blend the best of defined benefit and defined contribution plans.

The Bottom Line

Retirement planning might seem daunting, but understanding the basics of pension systems is a powerful first step. Engaging with a financial advisor, exploring the pension options available to you, and taking an active role in your retirement planning are critical steps toward ensuring a comfortable and secure retirement.

Remember, it’s never too early or too late to start planning for retirement. Your future self will thank you! 🚀

References

- https://www.visualcapitalist.com/ranked-the-best-and-worst-pension-plans-by-country

- https://www.oecd.org/finance/private-pensions/globalpensionstatistics.htm

To make our community even richer and more interactive, I invite you to participate actively! 🙌

Share the posts you find interesting, express your reactions, and don’t hesitate to leave a comment. Each of your actions helps spread financial knowledge to a wider audience. 📢💬

I am particularly interested in knowing your point of view: comment with your feedback, suggestions, or topics you would like to delve into. Your opinion is valuable for improving the content and offering insights more in line with your needs. 🔄🔍

Together, we can build a community where finance is accessible to everyone. Thank you for your support! 💖

Disclaimer 📜

Please note: The content shared across our channels, including articles, videos, and podcasts, reflects personal opinions and experiences. It is not intended as financial advice or an endorsement of specific strategies or products. 🚫

This information serves educational purposes only and should not be taken as professional financial guidance. Before making any financial decisions, we strongly recommend consulting with a qualified financial advisor. 📊➡️👨💼

Vai volando cuggi

LikeLike

❤️

LikeLike